Short selling is the process of selling an asset with the idea of profiting from falling prices. The trader will borrow an asset that they do not own, sell it to another trader, with the idea of buying it back and keeping the price difference.

What is short selling? – Definition & Example

Short selling is a trading strategy that speculates on falling prices in a stock or other asset. It is a strategy that experienced traders and investors use for a multitude of reasons. In fact, it is not always about profit.

Traders quite often will use the process of “going short” as a form of speculation, while portfolio managers may use it as a hedge against downside risks of a long position in the same market or a correlated one. Speculation is of course somewhat risky, and as a result, needs to be approached with caution.

When you are short selling, you are opening a position by borrowing shares of a stock or another asset that you believe will decrease in value. The trader then sells these borrowed shares or assets to buyers that are willing to pay the market price. Before the borrowed shares or assets must be returned, the trader is betting that the price will continue to decline and that they can purchase them back at a lower cost.

At the end of the trade, the trader is hoping to keep the difference between the selling price and the price at which they had bought the security back.

Short Selling Example

The following is an example of short selling a stock. It works the same way regardless of the company, or the exchange that it trades on. Keep in mind this is an example of shorting stocks and not the CFD market which is much simpler.

You do your analysis on company ABC and decide that it should start to fall in price. ABC is currently trading at $100, and you anticipate that the company will start to drop in value over the next several months. You borrow 100 shares at that price, with the hope of ABC dropping to $75. You are now “short” 100 shares of the company.

Shortly thereafter, the price starts to fall. The market eventually reaches your price of $75, and you buy back shares at a lower price resulting in a profit. As you have 100 shares and they have dropped $25, it adds up to a gain of $2500, minus any fees that are incurred during the holding period.

However, the stock may rise in price. In that case, the trader will incur a loss. Taking the same example above, if the price had risen to $110 and the trader closed out the position, they would lose $1000, as well as any fees that were incurred.

Let us take the same example but use it in the process of hedging. While there are multiple ways and calculations that you can use in order to hedge your position, the most straightforward is to simply short the same amount of shares in a company that you own. This effectively makes you “net neutral.” If you owned 100 shares of ABC while shorting another 100 shares, this means that as the stock falls in value, your short position is gaining profit, offsetting the losses in the longer-term core holding. Granted, this is a very basic example, but it gives you an idea as to what hedging is trying to accomplish.

More often than not, when a trader chooses to hedge a position, they will find a correlating asset or company. If company “ABC” was a technology company, they may choose to short Microsoft while holding the longer-term position in ABC. The thinking is that most sectors of the stock market move in tandem, so if ABC does start to incur losses, other similar companies will as well.

What Is the Purpose of Short Selling?

There are only a couple of reasons why most people decide to short sell, speculate and hedge an existing position.

- Speculating: Market speculators will look for an overpriced asset so that they can profit from falling prices. Short selling is simply the idea of profiting from an overbought condition in the market or a bet on a lack of demand for that asset.

- Hedging: There are times when a longer-term position that an investor holds may run into a bit of volatility. In these scenarios, sometimes traders will short sell the same asset or a correlating one to buffer any losses to the downside. This is a common strategy among institutional funds.

What Are the Benefits of Short Selling?

There is a multitude of benefits when it comes to short selling. The most obvious of course is the ability to profit on a falling market. While most traders do not typically bet on the market falling, those who can go in both directions open up a world of opportunities. The possibility of profit windfalls is numerous, especially when the underlying company or asset has a major fundamental flaw.

Another major benefit is that there is little initial capital required, normally just some type of margin deposit. Because of this, you can lever your position in ways that most buyers never get to experience, at least in the stock market. In other markets, this is not as big of a difference, but most of the time that markets are falling, it is generally due to fear, which quite often will show massive momentum.

Short selling also offers the possibility of hedging existing positions, mitigating losses that could pile up due to short-term volatility. Ultimately, selling short against an existing position means that if it does fall, you are compensated by the short position. Sometimes, traders will find correlating assets or companies to do the same thing as well.

What Are the Risks of Short Selling?

Although windfalls can be made shorting an asset, there are some risks that you should be aware of when it comes to short selling.

- Unlimited potential for loss: When going short, there is the theoretical possibility that an asset will rise against you. It is also theoretically possible that your losses could be unlimited. In practice, this is not normally a concern, at least not in liquid markets. Prudent money management and stop-loss placement is the best remedy.

- Additional costs: When shorting some assets, the costs can pile up. You initially have to borrow money from your brokerage, and you have to open up a margin account which typically comes with a minimum margin requirement. (We measure margin on a “per trade” basis at atlasexpertrade.)

When you trade stocks, for example, you have to pay interest fees that will gradually add up until you return the borrowed shares. Another reason why shorting stocks gets difficult is that there can be hard to borrow fees based upon the stock’s availability.

- Trading restrictions: Some regulators will restrict who can short sell and when investors can occasionally. This is generally in times of extreme financial stress, and almost always a stock market phenomenon. However, you can have “limit up” or “limit down” days in the futures markets. This is when price breaks a predefined range.

- Short squeezes: A short squeeze is when a cascading effect of bullish pressure forces more and more short-sellers to buy back their positions, increasing the upward pressure in a nasty feedback loop. These can be especially dangerous in relatively thin markets.

How to Manage Short Selling Risks

Managing your short-selling risks is relatively simple. There are a few things that you need to keep in mind when you are shorting an asset, which will keep you out of serious trouble. Much like buying an asset, most of this comes down to money and risk management on your trade.

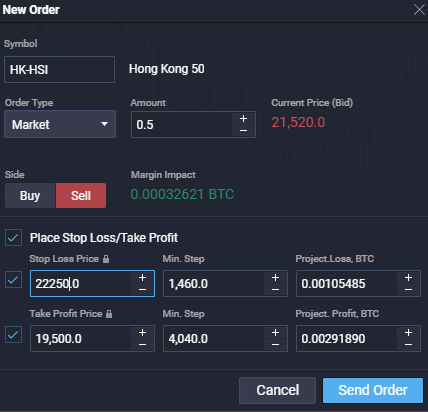

You should attach a stop-loss order to every position you put on, regardless of whether it is a buy or a sell position. The stop-loss order will keep you out of serious trouble, as it will tell your broker to get you out of the market as the position no longer looks viable. By placing this protective order, you can mitigate losses.

You should also pay special attention to the size of your trade. Risking an outsized amount of your trading capital is a very dangerous way to live, and it will only be a matter of time before you blow the account. Approach short-selling just like you would any other position, risking an appropriate amount of your account per trade.

Unlike buying an asset, you should have a target in mind at all times. For example, the trader who buys a stock or commodity at a specific price might be willing to ride the trend for a significant amount of time. However, you are looking to profit off of the fall of an asset, it can only fall so far. Because of this, a limit order is a good idea.

Make sure that you are trading a liquid market. atlasexpertrade only offers markets that are heavily traded, so with us, there will be no issue. However, some assets are not as heavily traded, so it may not be easy to get out of the position if the time comes. This can be especially destructive to a trading account if you are in a thin market and cannot get your order filled.

Have a strategy. This is going to be true no matter what you are trading, but it is even more so important with shorting it a market. You need to know when it is time to get in, and more importantly when it is time to get out. Make sure that your strategy is historically profitable. You can calculate this by doing what is known as “backtesting”, which is calculating how your trading system has performed through historical data.

Short selling strategies

To take advantage of the falling prices and a market, you need to have a few short-selling strategies to profit from these conditions. While there are numerous possibilities, the following are some of the more common ways to trade a market that is in a downtrend.

Strategy 1 – Pull back to EMA strategy

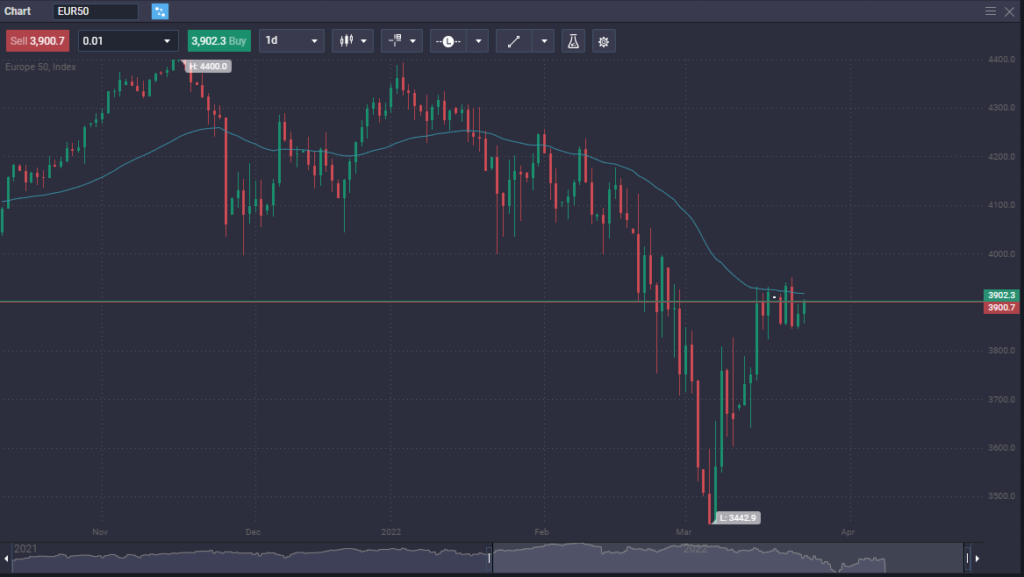

A very common way to enter a short-selling position is to wait for a pullback into a commonly followed moving average. For example, you may wish to short a market that has been in a downtrend for a while, but you also recognize that chasing the trade is a foolish way to lose money.

In this scenario, you can take a common moving average such as a 50 Day EMA and wait for the market to bounce towards it. Once it does, you put on a short position. The more common moving averages for this will include the 50 Day, 20 Day, 200 Day, and 9 Day. That being said, experiment with various moving averages to find what you are comfortable with.

Another thing to keep in mind when using this strategy is that most traders will look for some type of candlestick or formation at these moving averages to confirm the potential short sale. This is because moving averages are considered to be a lagging indicator, and therefore sometimes the markets can ignore them.

Strategy 2 – Big figure strategy

Another strategy that some traders will use is a “round number” as an entry. For example, traders will pay close attention to the overall trend and then wait for a break of a significant level such as $50, 1.00, and so on. This is because there are quite often areas where large institutions put orders into the market. You can expect to see support, so if it gets broken, that is a piece of information you can take advantage of.

It comes down to the individual trader as to how they enter the market, but it is quite common to wait for a daily close below one of these major levels to get short. This is quite often a way to avoid a “false break down” in the market, when a major level is breached, only to see price reverse. Typically, traders will also have a set amount of tics they will allow the market to go against them before acknowledging a false breakdown has happened.

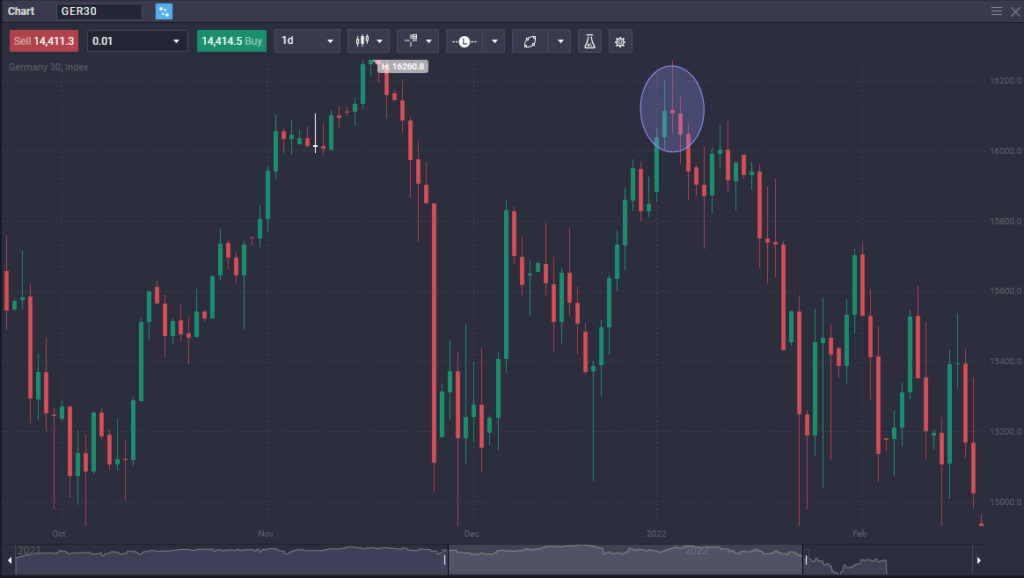

Strategy 3 – Shooting star strategy

Some traders look for shooting star candlesticks on a daily chart to start shorting. This is a candlestick that shows an attempt to break out to the upside but then gives back those gains. The candlestick suggests that buyers are running out of momentum, and therefore if we were to break down below the bottom of the candlestick, then it shows that not only has momentum slowed, but traders who are long of the market are starting to lose money.

In this scenario, these buyers have to sell their positions to cover massive losses. This starts a bit of a “feedback loop” that exacerbates the selling pressure, allowing the short seller to take advantage of the sudden fear in the market. Quite often, a shooting star candlestick is the beginning of a significant reversal, especially when seen in a higher time frame.

What to Consider When Short Selling

There are specific things to think about when shorting a stock or any other asset. Shorting does work a little bit differently and therefore has different inherent risks than buying an asset. Because of this, there should always be a few things in the back of your mind when “going short.”

Shorting an Asset Uses Borrowed Money

When shorting an asset, you are using borrowed money. This is what is known as “margin trading”, borrowing money from your broker to trade the position. You put up a certain amount of margin as collateral on the position. If your position goes against you far enough, you will be given what is known as a “margin call”, which will close out the position.

Timing Can Be Difficult

Even if an asset is overpriced at the moment, that does not necessarily mean that it has to fall in value. It can take quite a bit of time for the price to catch up with reality, and therefore it is not necessarily a given that you will be profitable. Having said that, you can say the same thing about going long.

You should not let the idea of timing be a deterrent, because just as with any other type of trading, having a profitable system will give you the confidence of “timing the market”, even though it takes a certain amount of skill. This goes back to backtesting your system and knowing how it typically behaves.

The Short Squeeze

The most dangerous situation you can find yourself in when short selling is what is known as a “short squeeze.” This is when traders see a jump in price and are forced to buy back their short positions. This generally causes a feedback loop, where traders continue to do the same thing, thereby pushing prices higher in a rapid manner.

Some of the biggest losses you can incur happen in the stock market during a short squeeze but can also be seen with certain commodities as well. In theory, a short squeeze can happen anywhere, but stocks and commodities are the most common places to find them. In commodities, you can have markets go “limit up” several days in a row under extreme conditions.

Potential Regulatory Risks

Some governmental regulators will impose bands on short sales in certain stocks, or the entire stock market itself. However, this is generally only an issue if you are a stock trader. As we do not offer individual stocks, this is never an issue at atlasexpertrade.

The sensitivity of regulators to the market will vary greatly from country to country, so as stocks go it is going to be difficult to gauge exactly when they will get involved. In the United States, the SEC tends to stay out of the markets unless there is an extreme situation. Typically, this is done on a company-by-company basis.

However, in some smaller markets, regulators are much quicker to get involved and ban short-selling altogether. It will be much quicker to shut down the entire stock market if it falls too quickly, with the regulatory reach being much quicker in centrally controlled economies such as China.

You Normally are Going Against the Trend

Over the longer term, stocks and commodities tend to drift higher. Because of this, short-sellers are almost always against the multi-year trend. However, when you are talking about commodities, these selloffs can last multiple years. There is almost always a bid for these markets, so short selling is a bit more difficult on the whole.

This is not necessarily true in some markets such as the currency markets. As you are measuring two assets against each other, one asset is appreciating in value regardless of which direction the chart is moving. And currency trading, you are always “long” one currency, while being “short” the other.

Costs of Short Selling

Short selling is a great way to make profits in a downtrend. However, it is not without costs. Understanding the expenses incurred is a vital part of understanding the entire process. Keep in mind that most of these calculations are done “under the hood” of a trading platform that you are using.

Margin Interest

When short selling, margin interest can be a significant expense. This is especially true in the stock market. However, even in the CFD markets, there is a certain amount of interest that is paid. This is generally quite low, making the CFD market cheaper in the long run for short selling opportunities.

That being said, keep in mind that the longer a trade is open, the more interest that the trader will be responsible for during the life of the trade as it is calculated daily. This will be done automatically on your platform without any interaction needed.

Stock Borrowing Costs

When you borrow shares, there are fees that you will run into. There can be “hard to borrow” fees, which can be quite substantial. This can be because of high short interest, limited float, or other reasons. The fee is charged on an annualized rate that can be anywhere from a fraction of a percent to more than 100% of the value of the short trade. It is prorated based upon the number of days that the trade is open.

However, when you trade at atlasexpertrade, you do not incur many of these fees as the markets that we offer highly liquid assets that are not based upon single stocks.

You Might Be Liable for Dividends and other Payments

In the case of the stock market, short-sellers are responsible for making dividend payments to the holders of the stock that they borrowed from. Short-sellers also are required to make any payments on an account where bonus share issues, spinoffs, and share splits happen. All of these can be unpredictable events.

In the case of the assets, you will be trading at atlasexpertrade, you will only need to worry about margin interest, as dividends will not be a concern, nor will any “hard to borrow” fees. This greatly simplifies the process of “going short” any of the markets we offer.

Conclusion

In conclusion, short selling can be quite a profitable venture if done correctly. Money management is crucial when trading any position, but even more so when going short. There are extra fees involved in shorting stocks, so therefore it is something that should be approached with caution. However, if done appropriately, it can be very lucrative.

Hedging is also one of the major benefits of shorting a market, as it gives you the ability to absorb losses in an existing stock position. This is typically done by longer-term traders who are looking to mitigate drawdowns in their portfolio of companies they plan on owning for the long term. Traders who have owned a stock like Amazon over the last several years may have chosen to hedge the position from time to time as an example.

You should know that at atlasexpertrade, the costs involved in shorting one of our assets are minimal, and therefore much more manageable. However, should also keep in mind that most assets involving commodities do tend to gain over the longer term, but the possibility of shorting one of these markets as it loses momentum is a great way to profit when others cannot.

Is short selling illegal?

No, it is not. The idea of short selling is a little bit strange for some people, but it does offer more liquidity into the markets, and therefore it is a useful part of any market. Remember, for every buyer, there has to be a seller.

Why do brokers allow short selling?

Brokers are not there to determine how the market moves, only to facilitate orders. Depending on what type of asset you are trading, borrowing an asset can incur financing costs, which rewards the holder of the asset in the form of interest. You borrow the asset; the original owner collects a little bit of interest. In this sense, it allows another way for clients to profit.

Who loses in short selling?

In short selling, if the market rises, it is the short seller who loses. If the market falls, then it is the buyer that loses. It should be thought of as the inverse of a typical trade.

Is it worth selling short?

It can be. It is like anything else in trading, if you have a reasonable strategy that has a positive expectancy, short selling can be very worthwhile.

Is it worth selling short?

It can be. It is like anything else in trading, if you have a reasonable strategy that has a positive expectancy, short selling can be very worthwhile.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of atlasexpertrade. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. atlasexpertrade recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.