It has been a relatively hard week for investors as not only have the stocks and commodities markets taken a hit, even the mostly uncorrelated crypto markets bled out. Markets have been interpreting good general global news as bad news for the prices.

This is not uncommon, however, it is also something that was to be expected from the cryptocurrency markets as these are also more in line with bad news. The bad news referred to is mostly when it comes to traditional markets so crypto can move in an opposite direction, but that was not the case this week.

The factors moving the traditional markets, like a spike in US Treasury yields, better-than-expected unemployment claims report, as well as an improving Covid19 situation in the US, are not the same ones impacting Bitcoin and other crypto. Those factors are closer aligned to what Elon Musk is tweeting on the day.

Big Fall Out

It was triple whammy for the markets as a spike in US Treasury yields, better-than-expected unemployment claims report, as well as an improving Covid19 situation in the USA sent all risk assets tanking. The markets see good news as bad news because an improving economy may lead the FED to cut back on its accommodative policies. Hence, the markets, which have been buoyed up by 10 years of ultra-loose monetary policies and cheap capital, is starting to unravel at any sign of a possible rate increase.

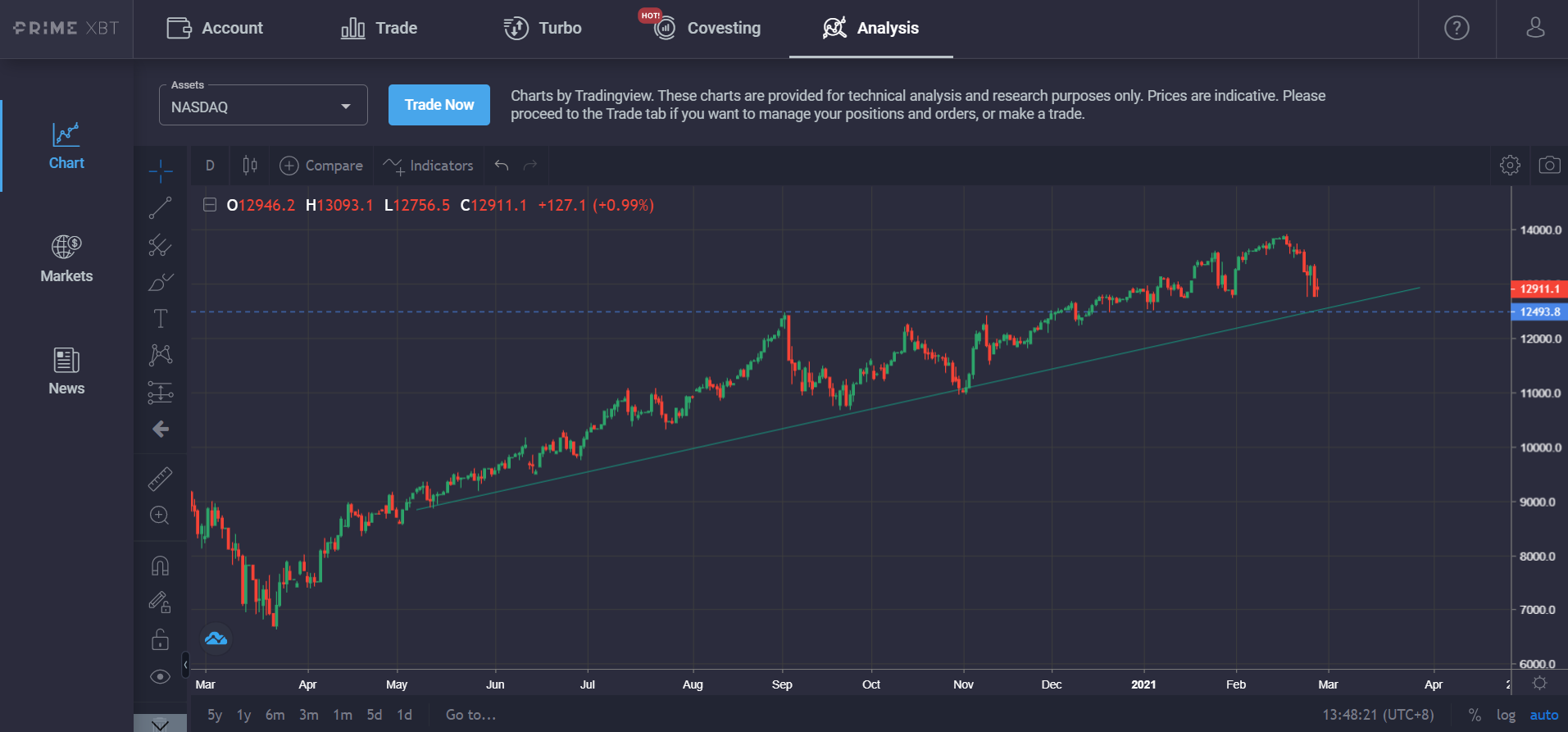

The Nasdaq was the main casualty in the stock arena as tech stocks led the selloff, with the index closing the week down 6%. The Dow and S&P both closed lower by around 3.1%.

Gold, Silver and Oil also traded lower, with the only gainer the USD, which has been brought up due to the possibility of higher interest rate on the back of better economic figures. The Pound, Aussie, Euro, all fell from their highs against the USD while the Dollar Index (DXY), staged a sharp rise from below 90.00 to a high of 91.00 within just 2 days on Thursday and Friday after Treasury Yields spiked.

There wasn’t anywhere to hide as even cryptocurrencies were hard hit, with BTC losing 25% on the week, leading the crypto market down. It was a bloodbath in the altcoins segment with many altcoins losing 50% from their peak made barely a week ago. These coins took a month to climb to the highs before the fall.

However, with the large selloff, prices are trading near their support zones, in particular, the Nasdaq has fallen near its support of 12,500. With yields stabilising on Friday, and Biden’s $1.9 trillion Stimulus Package approved by the House on Saturday, there may be a chance for a technical rebound. However, markets are still very jittery and all eyes will be on Treasury Yield movement this coming week to see if any rebound can be sustained, or if any rebound will be sold into.

Ever since Elon Musk’s comment that BTC and ETH prices seemed high, the price of BTC succumbed to intense selling from large whales and miners, taking the price down 25% from its peak of $58,300 to $43,000. The first selloff started on Sunday, 21 Feb, when price broke from its high of $58,300 to $47,400, before rebounding to $53,000, which was later sold into starting Monday, 22 Feb. The price of BTC has never recovered since.

How did The BTC Selloff Happen?

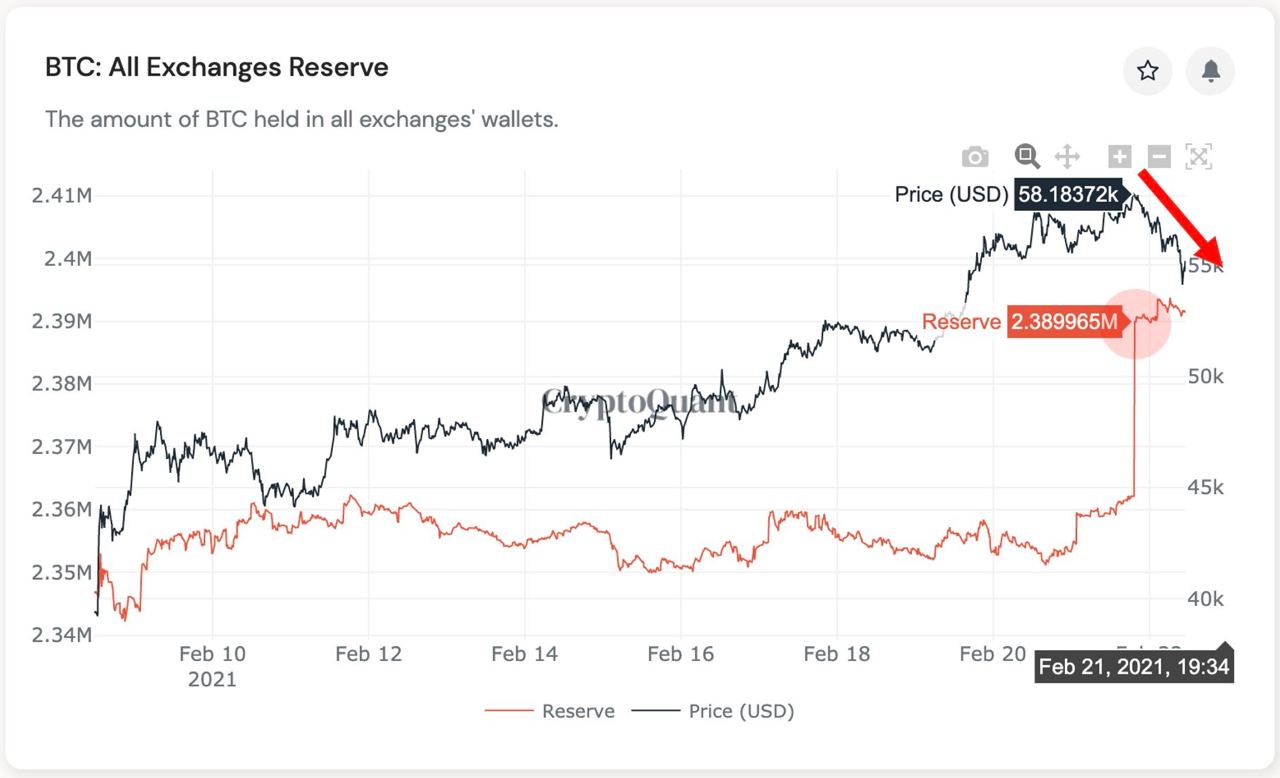

On-chain data discovered a big spike in BTC inflow to various exchanges before the selloff began on 22 Jan. The inflow was 11x its normal inflow and very likely caused the selloff when those BTC in the exchanges were sold.

Further analysis revealed that the inflow of BTC to exchanges was massive, as 59,915 BTC were deposited in a single hour, just as prices jumped over $58,300, and were subsequently sold, which brought the price of BTC crashing to $47,400.

To put things in perspective, the 200-hour resting average rate of BTC exchange inflow was only 5,032 BTC per hour. The deposit on Sunday was 11x its norm.

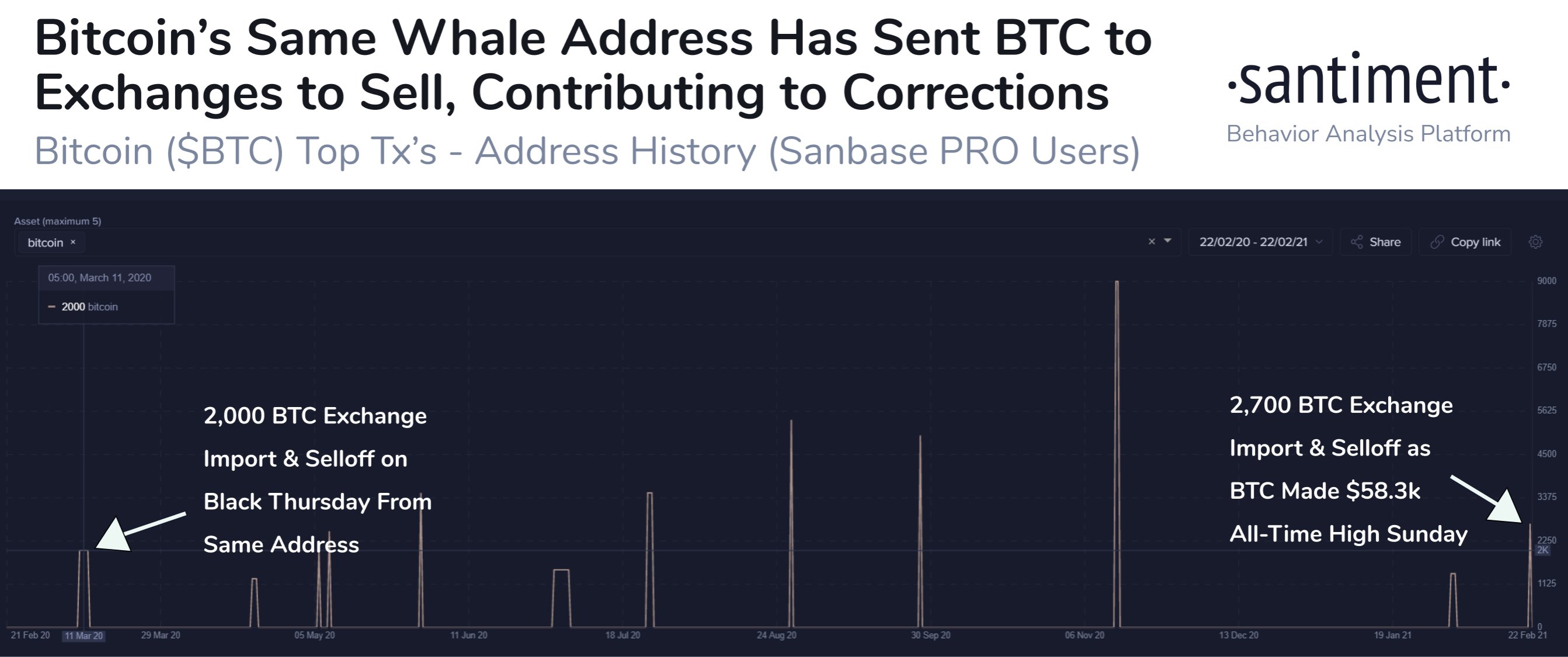

Of particular note is a whale who seemed to have front-run the selloff and sold 2,700 units of BTC just before the Monday selloff and cashed out $156M before the dip. The intriguing part about this whale is that he also sold Bitcoin just before the March 2020 crash. Can this whale have insider information about impending selloffs?

Some market observers blamed the mining operation F2pool for the recent dump as the mining pool had been selling BTC very aggressively for a few months. 3,633 BTC in a single transaction from F2pool was seen to have been deposited to exchanges and most likely sold during the selloff.

Some institutional investors took the selloff to accumulate more BTC, with Square reportedly purchasing another 3,318 BTC, worth around $170m. MicroStrategy also announced that they had completed their purchase of $1.02b worth of BTC at the average price of $52,700 on Wednesday. However, the news didn’t have any impact on the BTC price.

Square has reason to be optimistic on BTC price, as BTC contributed a lot to its 4Q2020 earnings. The company said that for 4Q2020, it sold $1.76b worth of BTC to clients via its Cash App. For the full year 2020, Square App made $4.57 billion in cryptocurrency sales which led to $97m in gross profits.

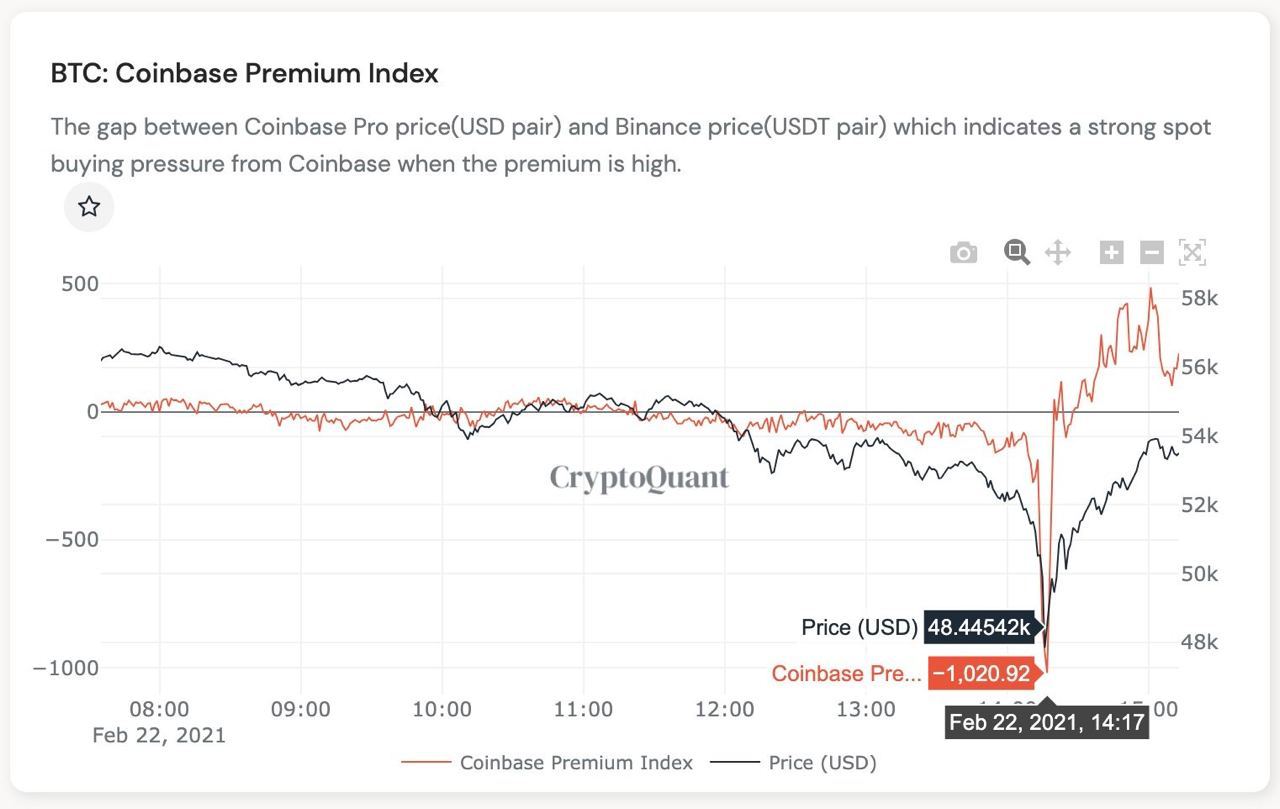

Coinbase clients on the other hand, were observed to be sellers initially, but turned buyers as the price of BTC plummeted to below $50,000. This can be seen in the rapid move in Coinbase Premium from negative to positive within minutes during the selloff.

Coinbase premium dropped to -1,020 and then reversed immediately to +498, suggesting Coinbase whales were selling and then buying during the drop, and brought prices back up initially.

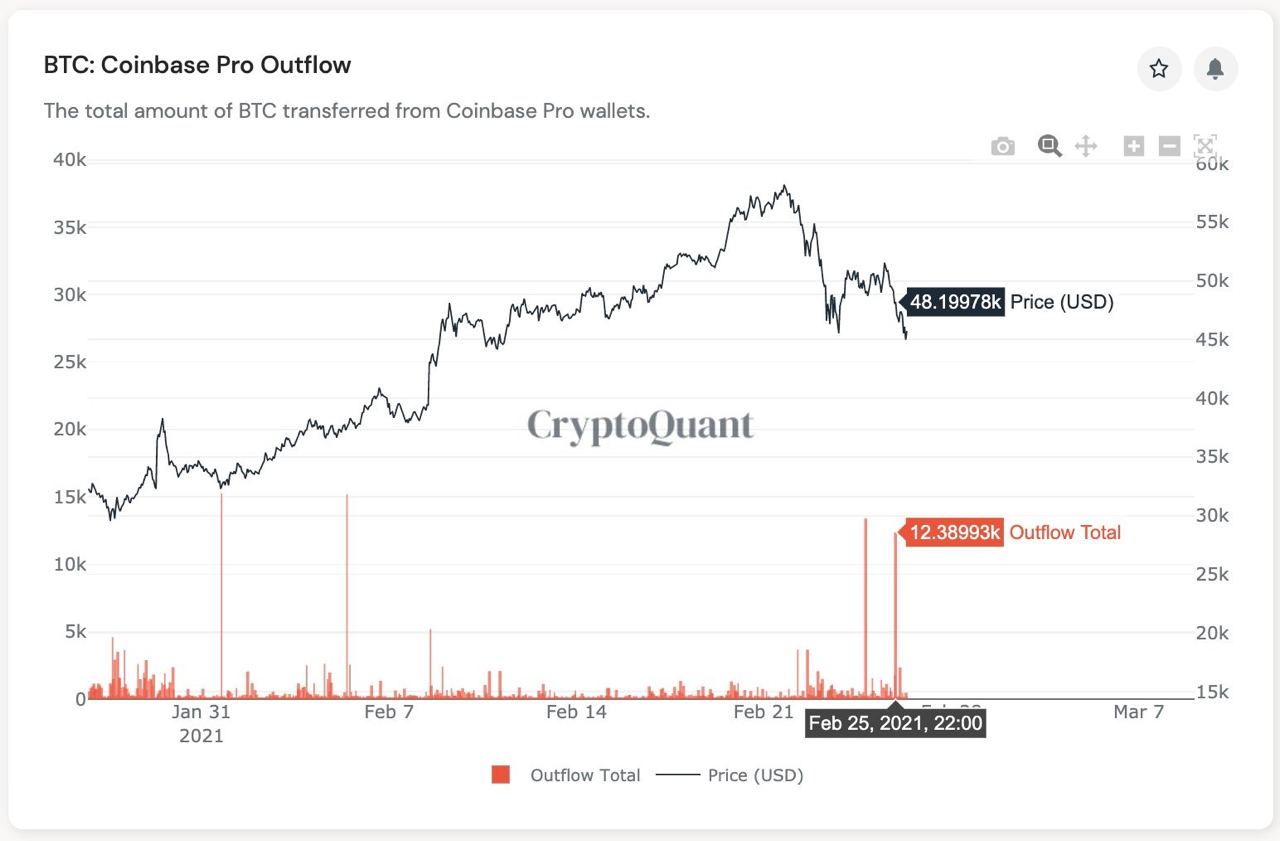

Subsequently, Coinbase whales bought BTC whenever it fell below $50,000, with 2 large blocks of 13,390 and 12,389 BTC seen leaving the exchange into various custody accounts held at Coinbase. However, the purchases didn’t stop BTC from dropping further as a sudden spike in US Treasury yields to 1.6% from 1.3% sent the USD soaring while all risk assets sold off, including BTC.

Furthermore, it looked like a concerted effort to talk down on BTC as both Janet Yellen and Charlie Munger of Berkshire Hathaway came out to openly dismiss BTC again.

The various institutional purchases of BTC did nothing to help the price as more units of BTC were observed to have been sold than purchased in Feb.

Institutional Purchases Lagged Whales Dumping In February

Data showed that whales offloaded massive amounts of BTC during February, selling around 140,000 BTC since the start of February, vs an aggregate purchase of only 80,000 BTC. Supply of BTC to the market has been almost twice that of the demand, which can explain the drop in BTC price despite news of institutional buying.

However, the phenomenon may not last very long as more BTC changes hands. Most new buyers of BTC are removing them from exchanges, which is reducing the liquid supply that can be bought or sold in the market.

Data tabulated shows that liquid supply of BTC has been declining further as we enter 2021, while illiquid supply of BTC continues on an uptrend. Currently, there are only around 3 million liquid BTC available for buy and sell, which will make the price of BTC more sensitive to large flows, whether they be inflow or outflow. This has already been witnessed in February with the large upswing with news of Tesla’s purchase, and then a big fall after Elon Musk said the price of BTC was a bit high. Expect more volatility to continue with the price of BTC, until such time when demand clearly exceeds supply. Hence, more institutional adoption is needed for BTC to reduce its volatility.

With BTC being hammered throughout the week, the rest of the crypto market felt the chills, with altcoins falling drastically from their peaks. Binance Chain related tokens like BNB, XVS and CAKE fell 50% from their earlier rise, erasing more than half of their newly found market cap in just 1 week. Many other altcoins were not spared from the carnage, with ETH also falling from $2,000 to $1,300, around 35%.

Most tokens have erased almost all their gains made in February, with the exception of a few coins which were still able to carve out gains. ADA and MATIC continued to rally and made ATHs, with ADA hitting $1.50 and MATIC $0.24.

With BNB’s drastic fall and ADA’s dramatic rise over the week, ADA has now overtaken BNB to be the 3rd largest coin by market cap. Charles Hoskinson, the founder of Cardano, the blockchain by which ADA is the native token to, however, says that he is unaware of the reason for ADA’s sharp increase. The alarming 50% rise in price of ADA has since cooled off.

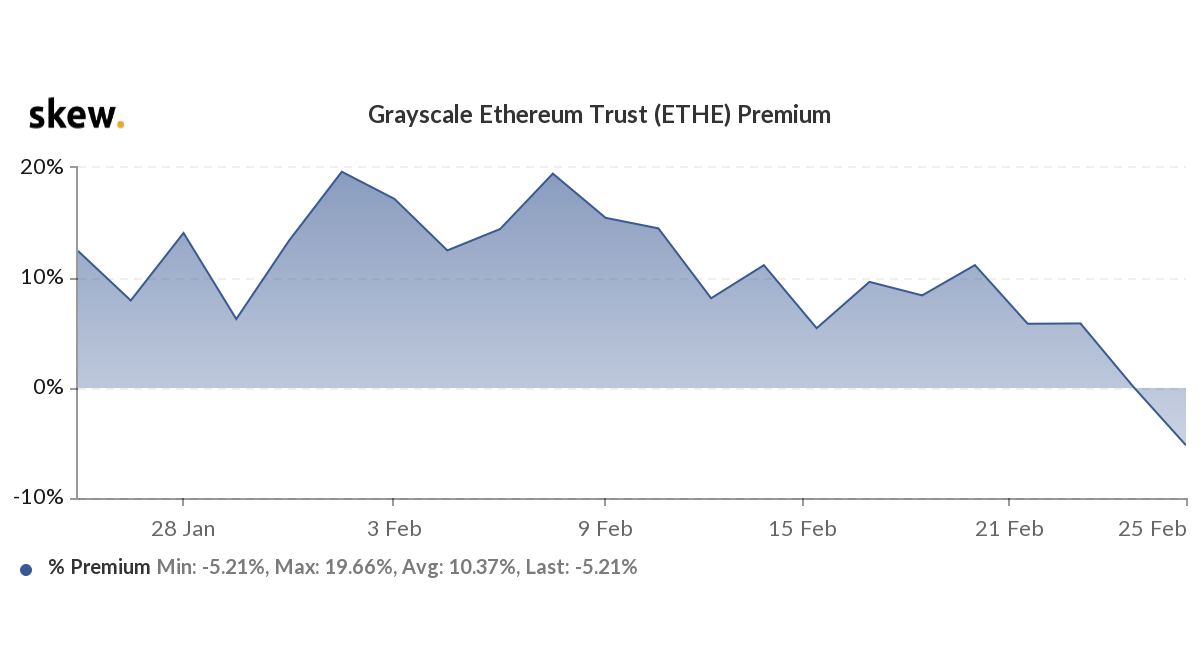

Grayscale ETH Premium Goes Negative

With problems of high fees and network jam already affecting ETH’s price during the times when the market was bullish, it hasn’t been a good week for ETH as it has fully retracted all its gains made in the month of February. ETH’s Grayscale Premium has also turned negative, a sign that investors have sold the ETHE Trust shares to bail out of ETH. While this may also mean that investors may be leaving Grayscale to buy ETH from another fund, it certainly doesn’t look very good for the sentiment surrounding ETH for the short-term.

There are cries for ETH 2.0 to start its scaling upgrade ASAP since ETH market share has been eroding, with clients moving to lower-cost blockchains like BSC, SOL and DOT. ADA, which will be upgrading its blockchain with smart contract capability in its “Mary” upgrade this month, rose significantly despite a big correction in the broad market, a sign that the market sorely wants a cheaper smart contract blockchain that can support DeFi projects on a larger scale.

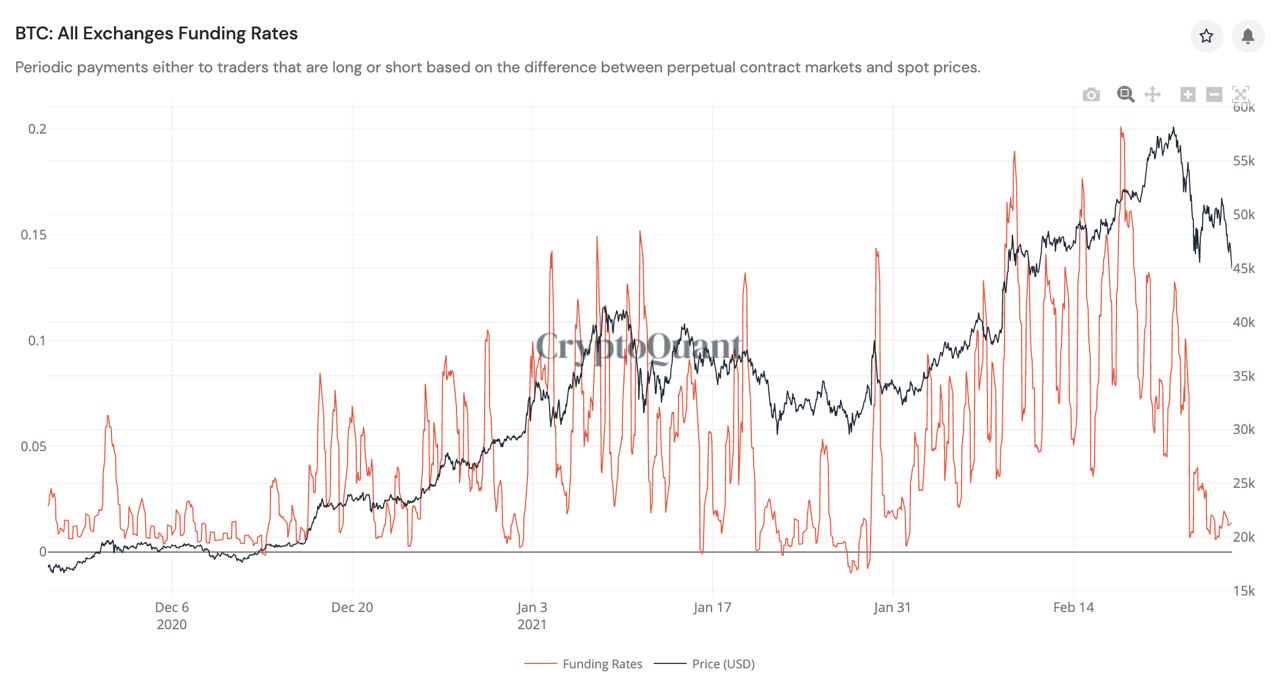

As the selloff continues on over the weekend, funding rates, which have gone up 10x from normal to 0.15%, have started to fall back to normal again, suggesting that most leveraged long positions have been closed out and the market is back neutral. In the 24 hours post the first selloff on 22 Feb, a record $5.7b in leveraged longs had been liquidated.

However, whether this drop in funding rate can lead to the recovery of the crypto market depends on how the yield situation plays out this new week.

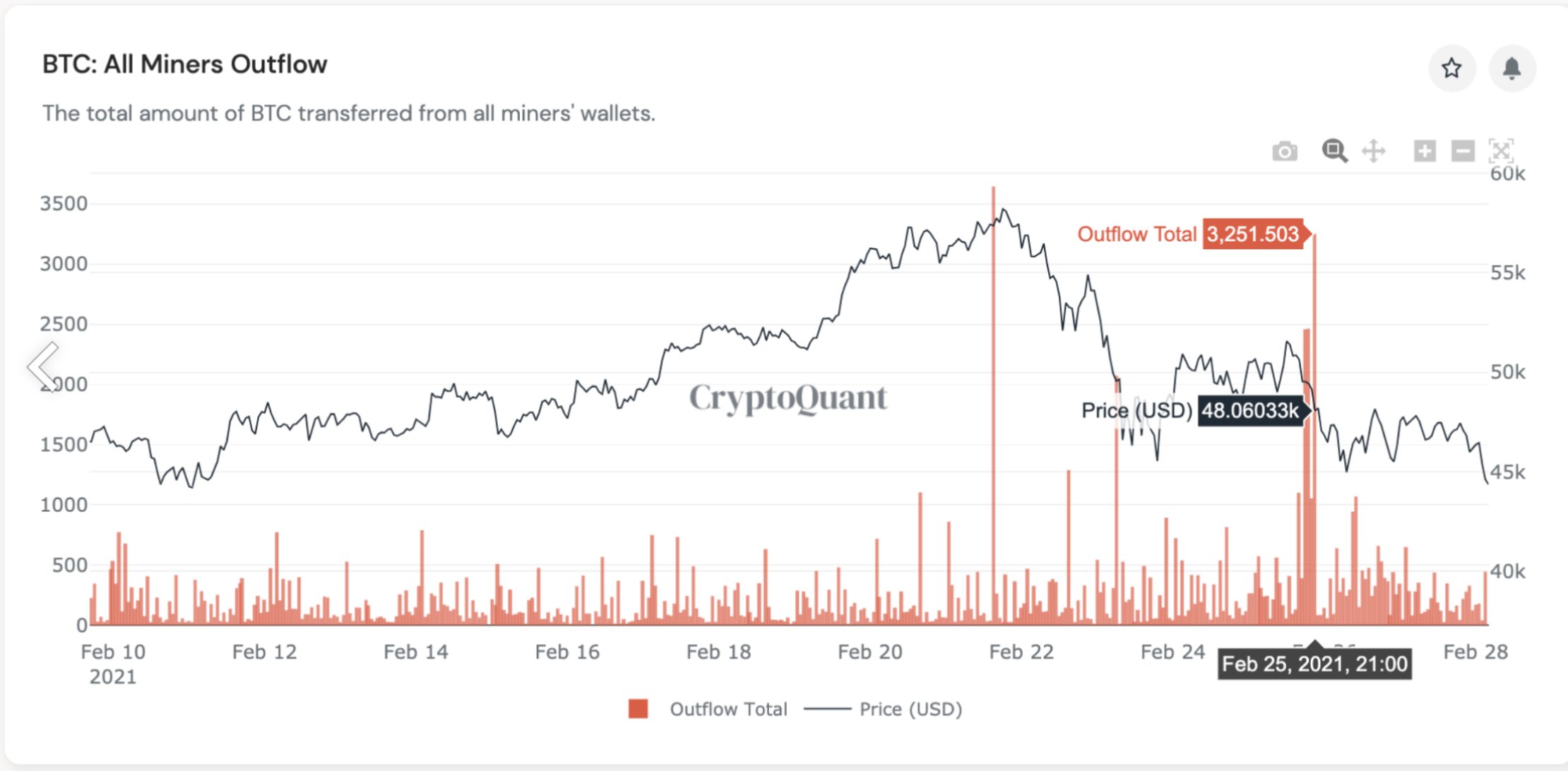

With the current price of BTC firming below $50,000, miners’ outflow has witnessed a sharp decrease after 2 large spikes last Monday and Thursday during the selloff. This implies that the selling pressure as we start this new week is a lot lesser than it was last week. Coupled with the drop in funding rates, there may be a chance BTC attempts a rebound this week.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.