It has been an incredible rise to a new all-time high for Ethereum, the second-largest cryptocurrency by market cap. The coin managed to break the important $3,000 mark in the past few weeks but has not stopped there adding another $1,000 to its price tag.

Excitement continues to grow around Ethereum, and other altcoins as a matter of fact, while Bitcoin seems happy to stay rather still in its own market. Some are seeing this as a new altcoin season beginning to burgeon, and it comes at a good time for traders who want the next big thing to come their way.

In the traditional markets, stocks closed higher last week despite a brief scare on Tuesday after Janet Yellen mentioned that the USA may need to raise interest rates sooner than anticipated to avoid an overheating in the economy which was showing signs of recovery.

Her comments spooked traders who took the chance to bail out of risk assets. Tech stocks and cryptocurrencies, in particular, bore the brunt of the selling as these assets were presumably riskier and would be impacted more by a rise in interest rate. However, a series of worse-than-expected economic numbers out of the USA soon doused that fear and investors began mopping up stocks and risky assets again.

Friday’s big jobs report miss gave investors assurance that the FED will not be raising interest rates anytime soon. A bad NFP report is especially comforting for traders as the FED assesses the strength of the labor market recovery before making any decision. The Dow rose 1.2% for the week, the S&P rose 0.9%, while Nasdaq rose 1.5%.

Gold and Silver benefitted the most from the weak economic figures, with Gold having its best week in 6 months, rising to a high of $1,840 after breaking the psychological resistance of $1,800 the week before. Silver is beginning the new week on a positive note, rising 1% to $27.70. Chatter about a Silver market squeeze is back again, which may put a bid under the price of Silver this week.

The USD bore the brunt of the weak US economic numbers, with DXY falling 1.5% for the week, and looking to be heading towards 89. Oil ended the week mostly unchanged, with the effects of rising COVID cases and the weaker USD canceling each other out. Oil is beginning the new week higher, up 1% due to USD falling further.

As usual, more activity is seen in the cryptocurrency market as news of large life-changing gains is being reported in the media, luring many new traders to enter the market in search of quick gains. Social media has been ablaze all week due to the hype surrounding Elon Musk’s hosting of “Saturday Night Live” where he was expected to be talking about DOGE. ETH also caused a stir in the market with its quick 1-day rise from $3,500 to almost $4,000 on Saturday.

BTC Recovers Above $58,000 On Dip Buying By Long-term Holders

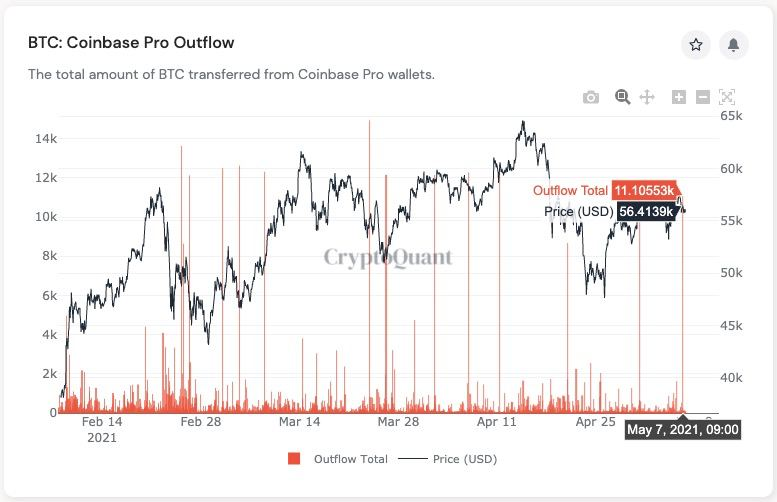

The post-Yellen-induced selloff, BTC recovered lost ground from the low of $53,000 to a high of $59,500 and has been trading between $55,000 and $58,500 since. Despite range trading within a 10% range all week, fundamentals of BTC remain strong, with metrics still pointing towards accumulation by long-term hodlers buying in the spot market. Friday saw 11,100 BTC flow out from Coinbase as institutions continue to accumulate as price attempts to test $60,000.

However, news of a 20% tax on mining activities announced by South Korea late Friday saw traders take profit into the weekend, proving once again that the $58,700 barrier is hard to break. However, weekend trading is often not a good indicator of the direction of BTC since this year’s bull market is led by institutional buying, which typically do not work on weekends even though crypto trades 24/7. Hence this week will be crucial to determine if BTC manages to move higher, or that more retracement could be in the works.

It is important to determine if the sellers are long-term holders or short-term traders as this may have a big impact on the price of BTC going forward. Long-term holders selling may signal more negative sentiment on the outlook than short-term traders who do not have as much long-term impact.

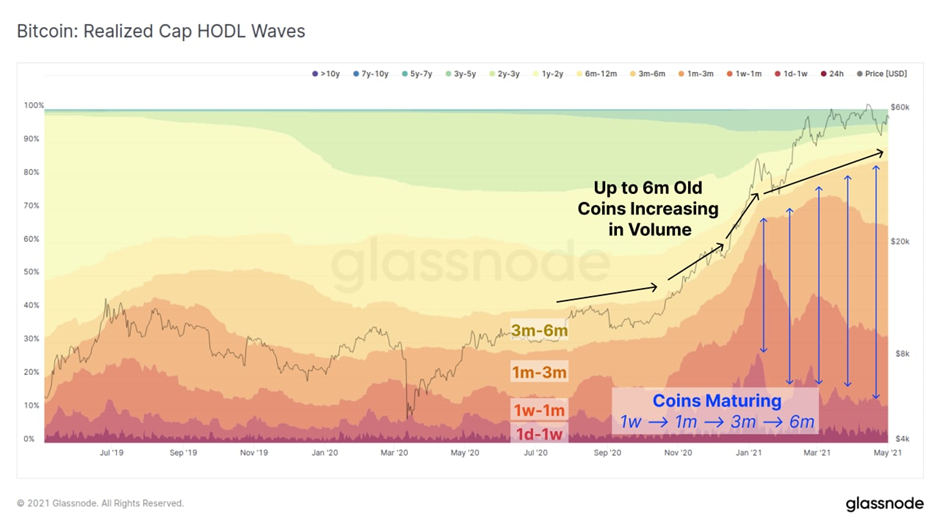

The long-term hodl wave ratio helps to determine this and from the chart, we can see that wallet balances that hold BTC for more than 6 months are increasing, while wallet balances that hold between 1 day up to 6 months have been decreasing. This shows that the sellers lately have been short-term traders and not long-term holders who instead, have been accumulating.

The rise in the number of short-term traders may be due to the current social media hype about the bull market which has brought in many new and inexperienced short-term traders who are in only to make quick profits.

Onchain Data Suggests Imminent Higher Prices Ahead For BTC

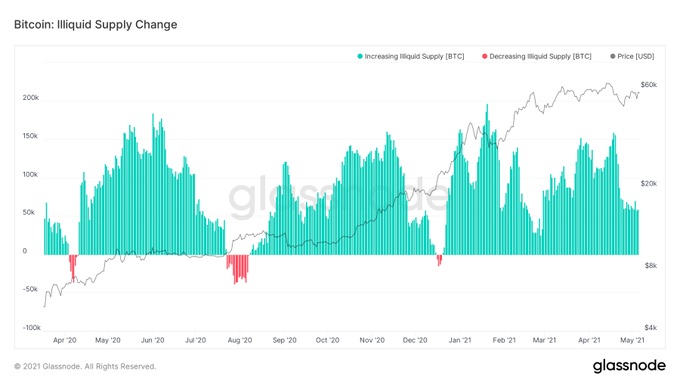

As short-term traders sell, long-term holders are continuing to remove BTC into cold storage. With more and more supply being locked up while price stays relatively constant, the price of BTC seems to be coiling up for a large move upwards. This could happen when the price of BTC breaks $60,000 again when these short-term traders turn buyers. As can be seen below, the illiquid supply of BTC has consistently been increasing, which may eventually cause a supply shock.

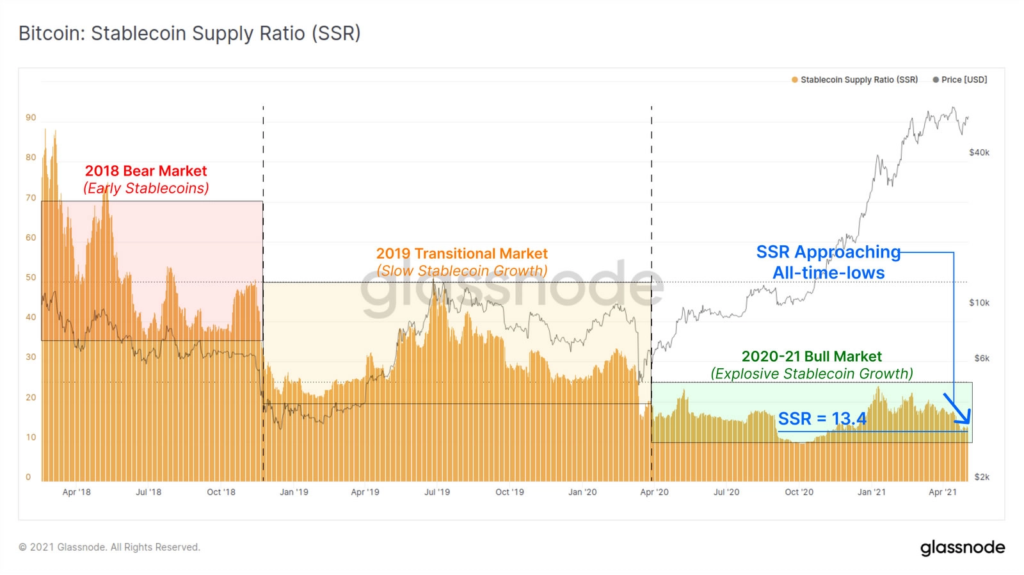

The stablecoin ratio seems to concur with this observation. A study of Stablecoin Supply Ratio (SSR), which measures the BTC supply divided by the stablecoin supply, is sitting at a year-to-date low of 13.4, and is approaching its all-time low of 9.6.

The chart below shows that SSR has been persistently low during 2020 and 2021 as stablecoin supplies have largely grown in proportion to BTC’s price appreciation.

A decreasing SSR value is a bullish signal that the global stablecoin supply becoming larger relative to the BTC market cap, this implies that there is increased ‘buying power’ of crypto-native capital that can be quickly exchanged and traded into BTC and other crypto-assets.

The liquidity on standby can enter the market anytime immediately when a catalyst is triggered. This could come in the form of positive news flow or a price catalyst in the form of a breakout on the technical charts. This also seems to imply that BTC could be coiling up for a big move upwards.

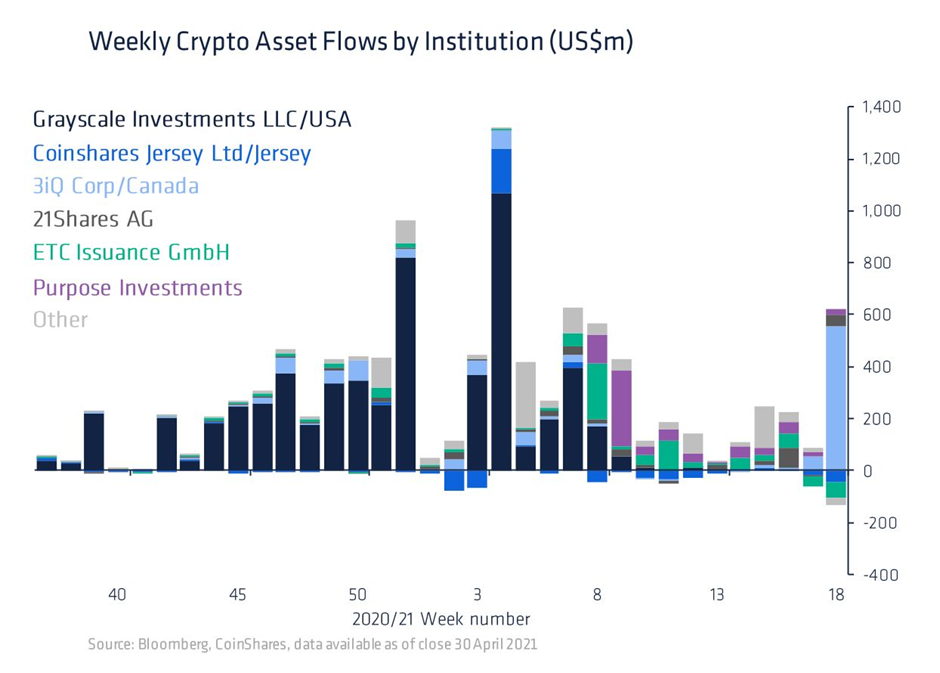

Institutional Demand Gains At Highest Pace Since Feb

Meanwhile, institutional fund inflows continue to increase, with around $490 million going into the market last week, the largest inflow since Feb.

ETH Breaks $4,000, Data Shows No One Is Selling ETH

It isn’t just BTC metrics looking very good, ETH metrics are displaying the same, if not, better health.

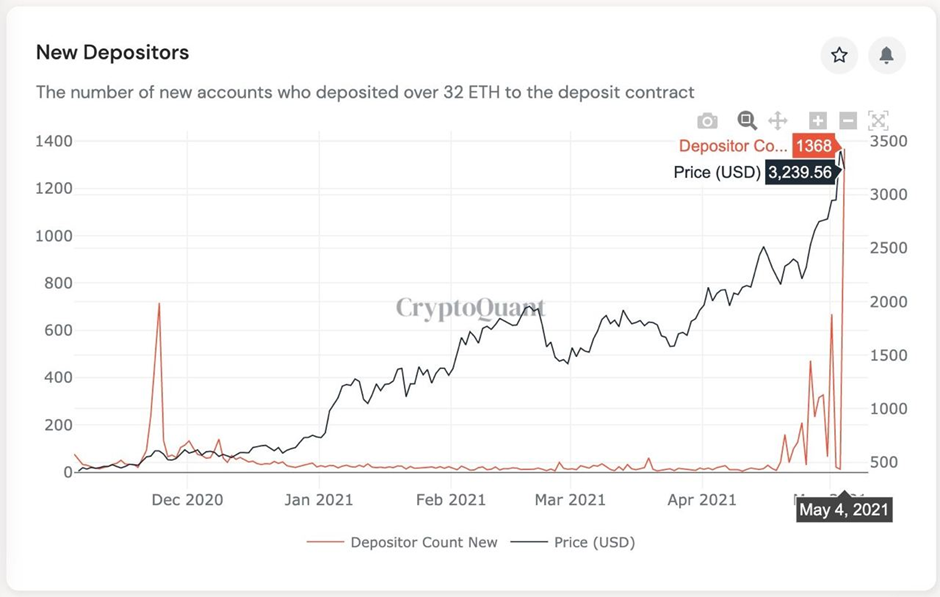

With price breaking $3,000 finally, there is newfound optimism on ETH, with new deposits into ETH 2.0 growing rapidly. Last week saw a spike in the number of new depositors who staked more than 32 ETH each to become a validator on ETH 2.0.

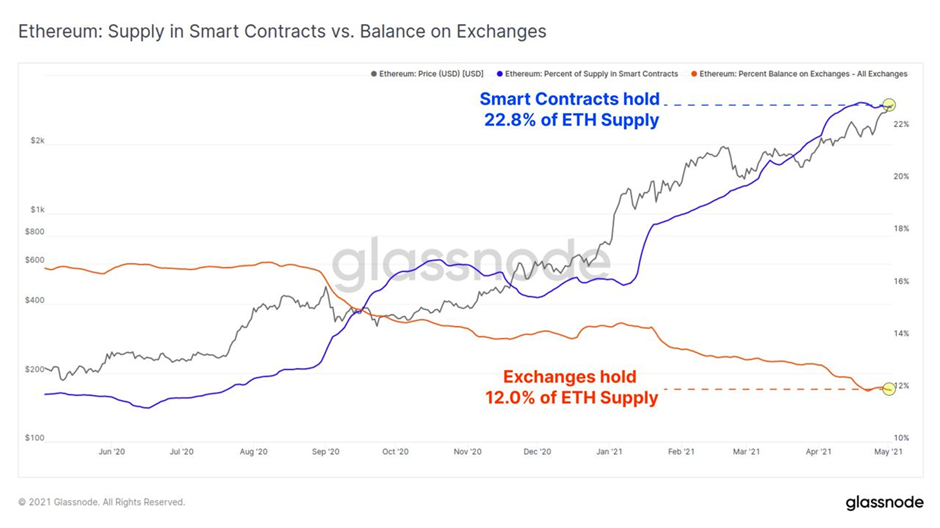

As more ETH gets deposited into ETH 2.0 and DeFi platforms, the liquid supply of ETH available for buy/sell continues to fall., with only 12% of circulating supply available on exchanges. ETH deposits locked in smart contracts have risen to almost 23% of supply, meaning these ETH cannot be sold in the market.

The supply crisis of ETH seems even more pronounced than that of BTC, which means that a price explosion in ETH could be even more intensive than that of BTC. This phenomenon is already happening with the price of ETH exploding to new highs in top speed, breaking $4,000 in a flash after it smashed $3,000. Experts are targeting a minimum $6,000 price tag for ETH by the end of this year, with some even calling for $50,000 in 5 years.

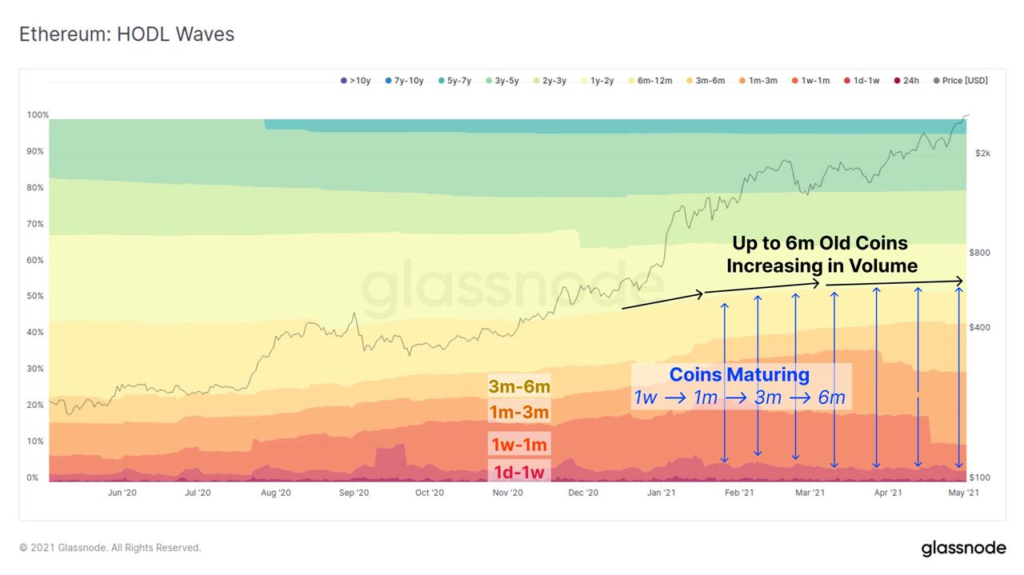

Analysis of the hodl waves ratio shows that even short-term traders are bullish about ETH as no one seems to be selling ETH. As we head into May, both short-term and long-term holders are not reducing the number of ETH held as the hodl curve remains flat.

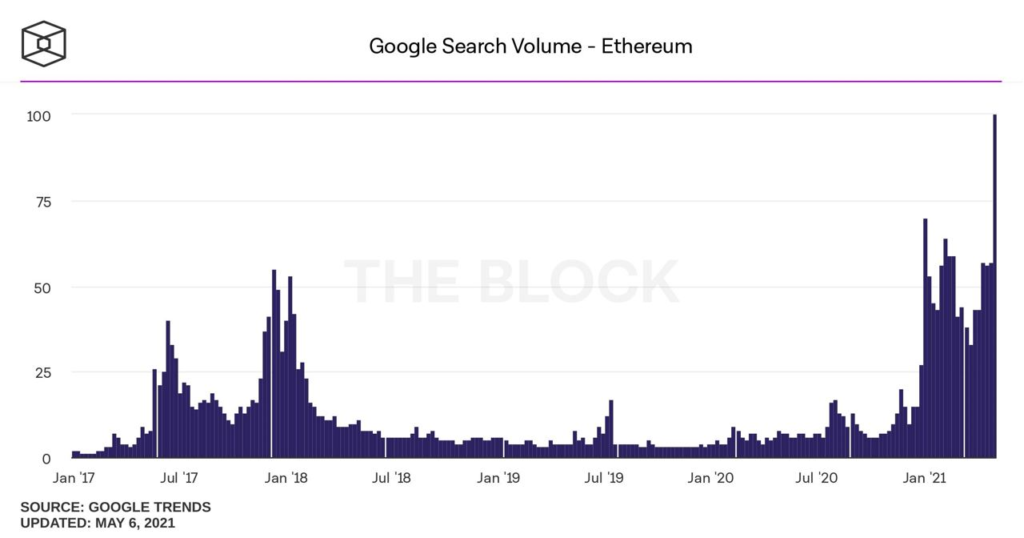

The quick rise in ETH’s price has brought many new traders interested, with the google search volume for ETH surging to a new ATH that is double that of the amount seen in 2018.

Putting this and the hodl wave ratio together, we can deduce that many new traders have been buying ETH. The surge in interest to buy ETH was so great last week that many new traders even bought the wrong ETH.

Altseason In Full Swing, ETC Gains 300%, DOGE in Focus

Ethereum Classic (ETC) gained 300% last week for no apparent reason as new traders who have never traded crypto before rushed in wanting to buy ETH, but ended up buying the wrong one as they didn’t know the difference between ETH and ETC, causing a huge surge in ETC price. This is a sign that a lot of new players are entering the market right now with fresh fiat money, which will likely increase the volume and value of cryptocurrencies further.

Another coin in the spotlight was DOGE, which was due to telecast its “Saturday Night Live” Elon Musk event on late Night on Saturday. In the run-up to the much-anticipated event, the price of DOGE rose 70% to a high of $0.74, breaking out of its former ATH of $0.45. This has brought DOGE right up to become the fourth-largest cryptocurrency.

However, during the event, the price of DOGE fell 35% to a low of $0.41 before recouping losses to trade back above $0.50 after SpaceX announced that it was accepting payment in DOGE from its partner, Geometric Energy, to launch the first-ever commercial space mission to the moon paid in cryptocurrency. The mission will be aptly named, DOGE-1, and is expected to take off in 1Q 2022.

ADA, another crypto popular with retail investors, also had a good week, rising from $1.25 to a new ATH of $1.84. Old crowd favorites like BCH and EOS also made fantastic gains. BCH rose 50%, while EOS doubled from $6 to $12 before retracing to around $10.

The rotational play in altcoins is set to continue this week. However, with the amount of mania in the market right now, big retracements following large surges are happening at the same time. Traders therefore ought to exercise prudence to not use excessive leverage and to take your profits along the way. Here’s to a great week ahead.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.