It has been quite clear that the cryptocurrency market, through most of 2021, had been riding on a massive positive wave. The price of Bitcoin was happily breaking all times highs to its top over $60,000 while other major coins followed suit.

Ethereum, on its way to a major update, was also making huge strides which was further backed by the growth of DeFi. Nothing looked like it could stop crypto, especially when Tesla CEO Elon Musk joined in the narrative and bolstered the likes of DOGE with his social media stance, and Bitcoin by accepting it as payment.

However, all this excitement has really come crashing down this week as a few pieces of tough news have derailed the market. Musk is a little more wary of Bitcoin now because of its potential environmental harm, while China has also come into the fray.

While the crypto markets crashed, even the traditional markets had a bit of a wild ride. It was a topsy-turvy week for stocks, as fears of an earlier-than-expected rate increase spooked markets again, and more so after FED minutes unveiled mid-week saw some officials signaling that the US could start on taper talks.

Tech stocks bore the brunt of the selling, with Tesla continuing to slide after calling off accepting BTC as payment. However, stocks reversed course beginning Thursday as improving jobless claims numbers were enough for some investors to get positive about the outlook for the economy.

Friday’s release of May’s Purchasing Managers’ PMI beat expectations, with a rise to a record high of 61.5 vs an expectation of 60. However, crypto-exposed companies like Coinbase and MicroStrategy were lower due to the huge plunge in crypto prices.

For the week, the Dow dipped 0.5%, Nasdaq eked out a gain of 0.3%, while the S&P was 0.4% lower.

Gold fared fairly well, ending the week with a gain of 1%, possibly benefitting from capital flows out of the cryptocurrency market. Silver was a tad lower to $27.60 after it failed to convincingly break $28.00.

The USD had been weak all week despite fears of rising inflation, with the DXY hovering around the 90 level for most parts of the week. Oil traded lower after a ceasefire by Israel and Palestine, closing the week at $63.86.

Most of the activity was centered on cryptocurrencies again, except this time, instead of maniac buying, panic selling was seen all over the place as BTC saw its biggest crash since March 2020, plunging almost 40% and dragging the entire crypto market down like falling dominoes. This round of blood-letting is the worst sell-off since March 2020, with the crypto-verse wiping out a hefty $1 trillion, akin to 50% of its total market cap.

China Sends BTC and Crypto Crashing Twice In a Week

Bitcoin shook crypto markets on Wednesday with a 30% plunge after Chinese regulators once again repeated old news about banning BTC mining and cryptocurrencies. Prices then fell the second time again on Friday after Chinese Vice Premier Liu basically repeated the same rhetoric.

Coming on the back of an already weakening BTC market due to the Tesla effect the week before, the China-FUD could not have come at a worse time to crash the market even further, downing BTC in a span of minutes, with it falling off a cliff from $43,000 to $30,000 within an hour.

The dip was bought up quickly with price recovering to $42,000, only for Chinese Vice Premier Liu to repeat the same rhetoric again on Friday, sending the price of BTC crashing the second time again to $34,000 before hovering around $36,000. This time around though, BTC couldn’t manage a rebound, with its price action looking rather weak over the weekend.

With such a plunge in the King of Cryptos, altcoins suffered even more, with the lead altcoin ETH suffering an even bigger plunge, falling from around $3,100 to below $2,000, before settling the week hovering at around $2,200, with price action looking increasingly precarious.

Other than the China FUD which came on Wednesday, Tuesday already saw the crypto market slowly dropping lower after the US Treasury announced a new tax regulation for crypto. With effect from year 2023, businesses with crypto transfers of over $10,000 will have to be reported to the IRS.

Leverage To Blame for Extensive Sell-off

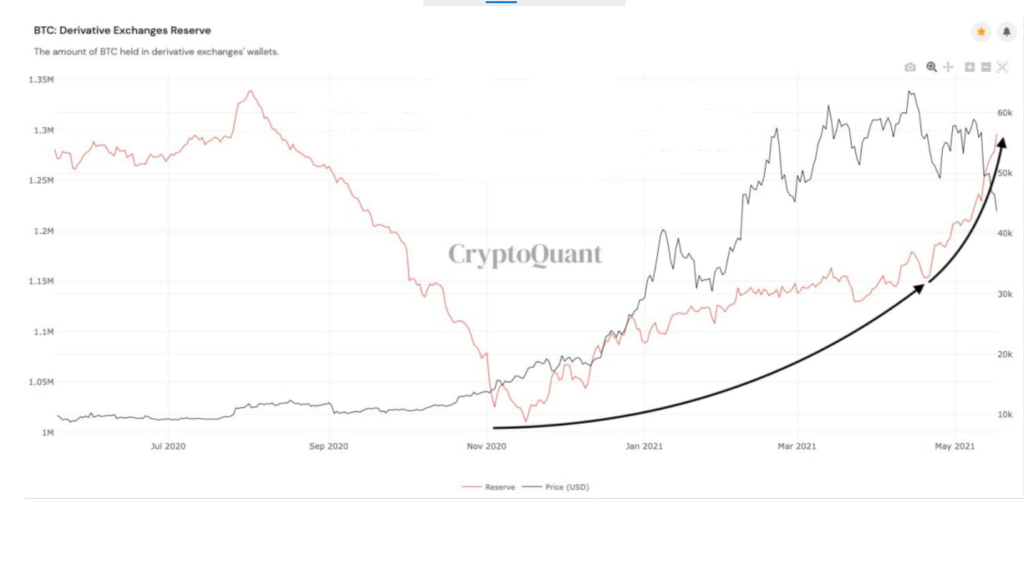

Despite exchange supply of BTC in spot exchanges continuing to decline, BTC deposits to derivative exchanges were climbing since March, and picked up pace in early May, suggesting that traders were using BTC as leverage to perhaps borrow more funds in order to trade, which could imply that the leverage in the crypto-verse was getting higher and higher. This could partly explain why when prices started to fall, they cascaded downwards very quickly since these leveraged positions needed to be cut.

In the first 24 hours of the plunge on Wednesday, around $8 billion worth of long positions were liquidated, a second-highest number in history that was only exceeded by the 18 April plunge which saw $10 billion worth of long positions liquidated. This suggests that despite the pullback in April, the system was still very leveraged as in previous market retracements, the average amount of long liquidation was only between $2 to $3 billion.

As the market tanked on Wednesday, more than 10,500 units of BTC were force-sold in 1 hour as price tanked below $35,000.

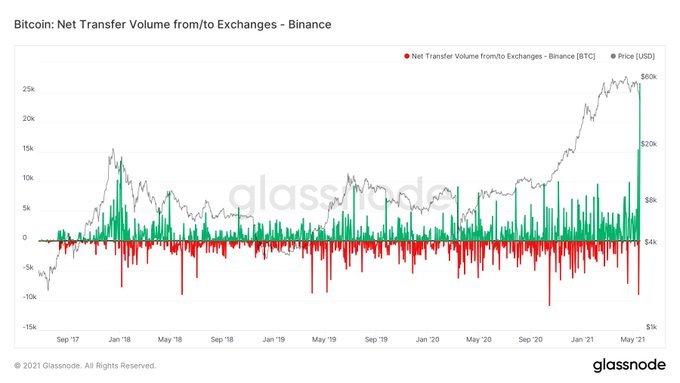

The largest retail crypto exchange Binance, also saw its largest ever BTC inflow of more than 25,000 BTC as the selloff intensified.

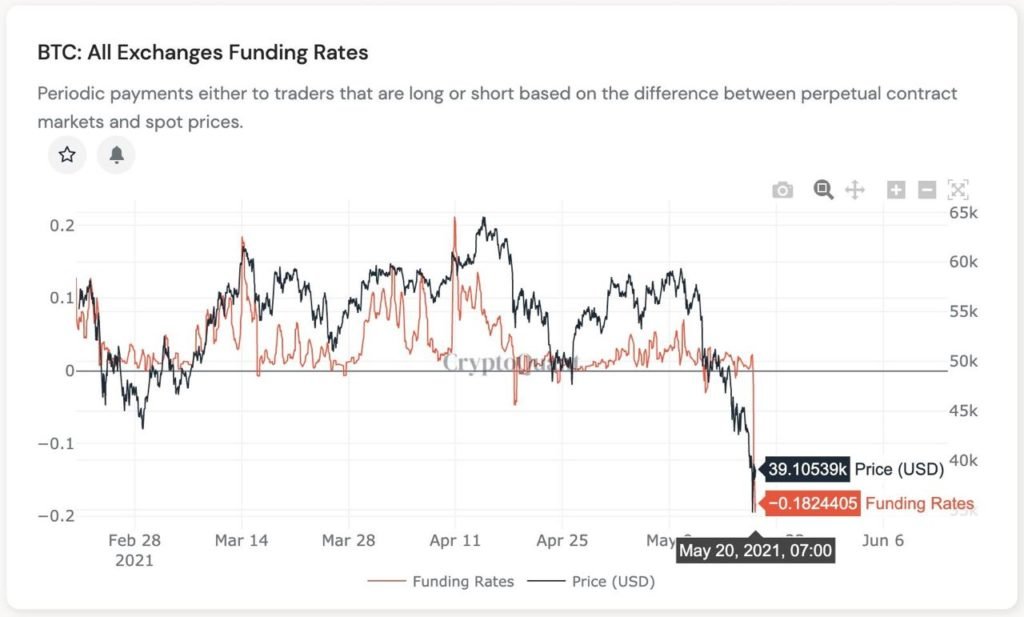

Funding rate subsequently fell negative post liquidation event where BTC price managed to recoup some of its losses.

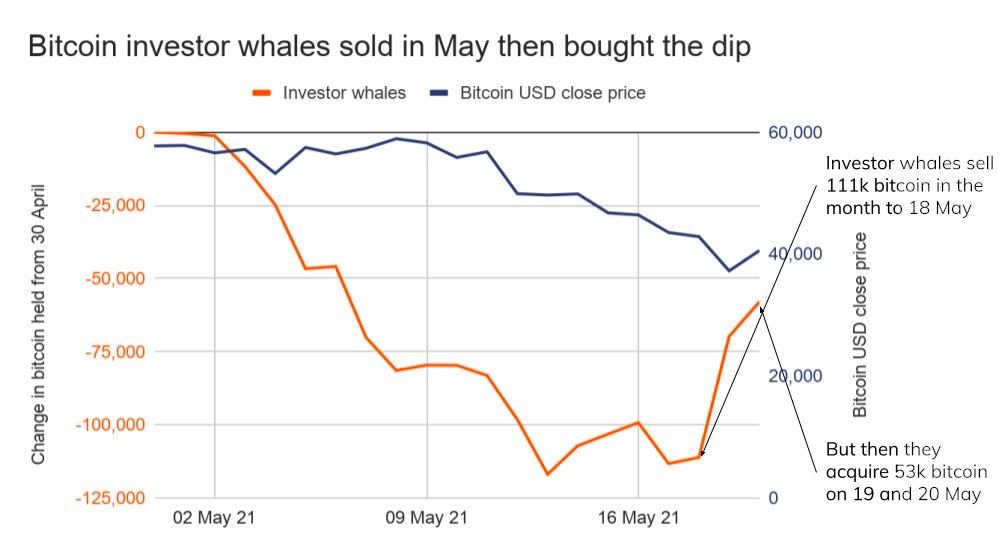

Some whales were observed to have sold 111,000 BTC at around $58,000, and have since bought back half the quantity during the dip.

Data Suggests Short-Term Traders Sold The Market

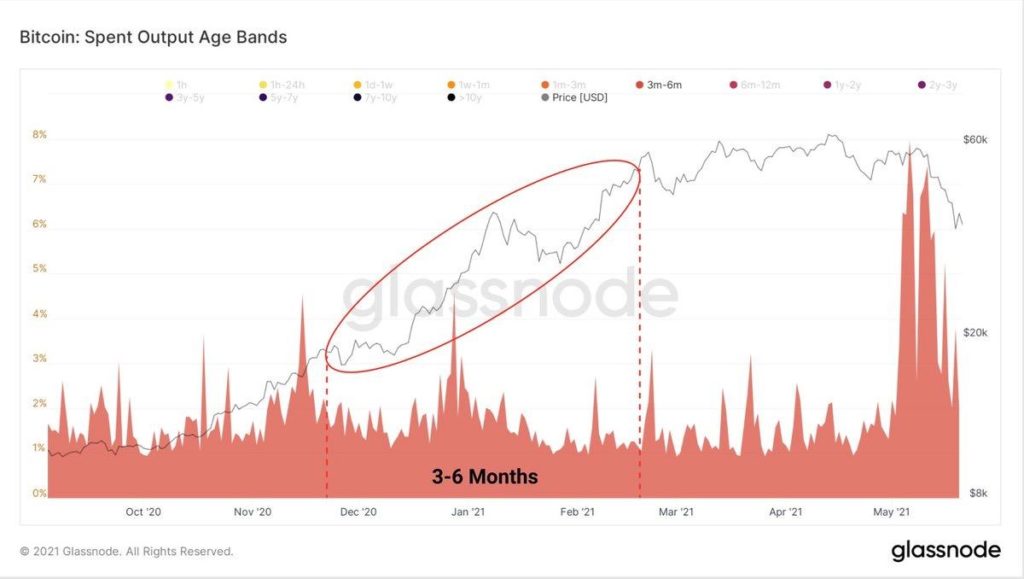

Further on-chain analysis shows that the bulk of the sellers in last week’s plunge were buyers who bought BTC earlier this year, with an average holding period of between 3 to 6 months only. This could be new investors who only entered the space to make quick gains and do not have the long-term commitment on the flagship crypto.

The spent-output age band below shows that the bulk of the selling came from holders who had kept between 3 to 6 months only, not the long-term hodlers were still accumulating, however, as MicroStrategy announced that it has bought both dips, spending $15 million and $10 million to acquire more BTC.

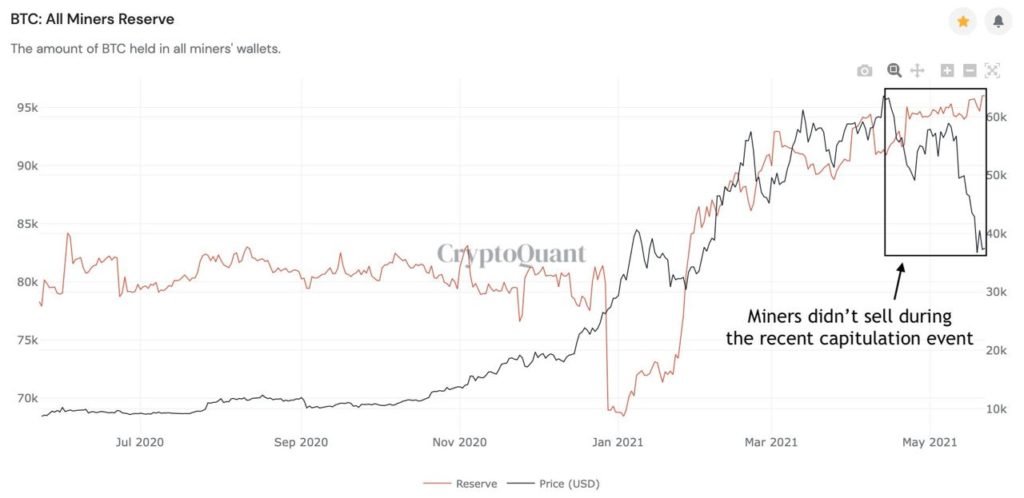

Other than long-term hodlers, miners also did not budge during the selloff. Miners’ BTC reserve continues to climb despite the fall in price, suggesting that miners not only did not sell any BTC, they could, in fact, be accumulating.

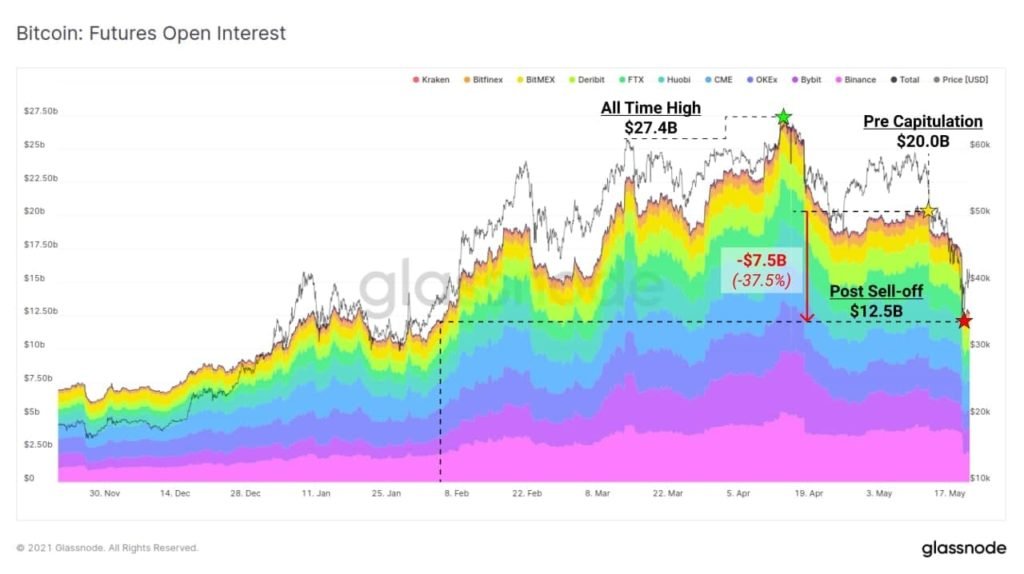

Open Interest Resetting Back to Feb Level

Post sell-off, the leveraged Futures Market Open Interest fell back to early Feb levels of around $12.5 billion when the price of BTC took off on another leg up after retracing from its early Jan peak. Could we see a repeat of BTC price action following this reset?

BTC Dominance Recovers As Altcoins See Worse Drawdowns

Meanwhile, with BTC crashing, altcoins did worse, and the largest altcoin ETH, saw its value drop 50%. As BTC began to consolidate, altcoins started sinking more as some traders could have opted to sell altcoins for BTC.

BTC dominance clawed back significantly to above 46% post selloff from a low of 40% before. Once again, the altcoin market is seen to be taking cues from BTC, with altcoins performing better when BTC was recovering, but selling off more drastically when BTC started to move downwards again.

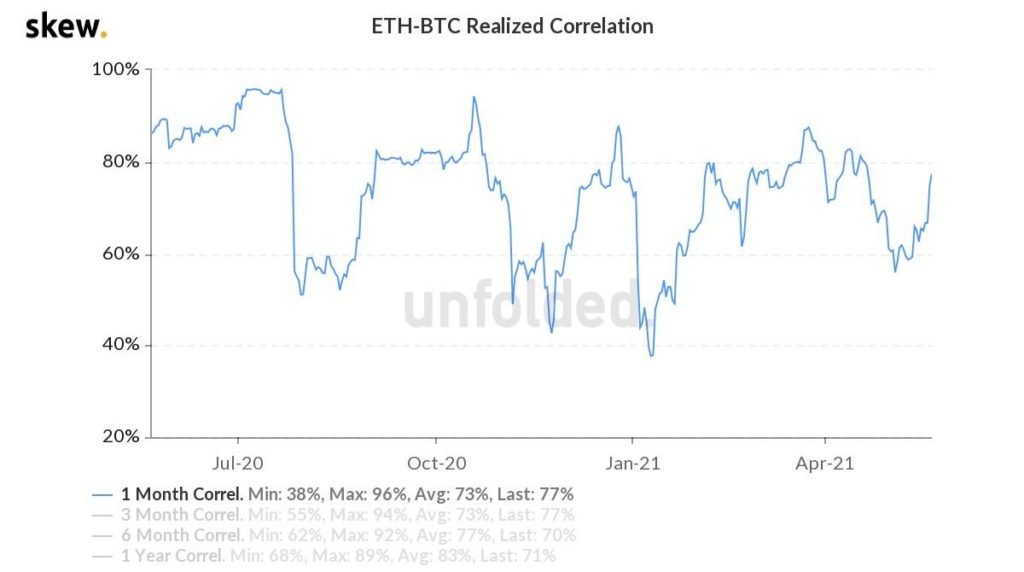

Even ETH was not spared from BTC, with the ETH-BTC correlation spiking back up again after declining since April when investors started piling into ETH when BTC was stuck in a range.

Altcoins suffered badly in the aftermath, with the most popular tokens witnessing the largest losses.

Current hot favorite coins fell between 50-70% from their peaks, with MATIC, which had risen to $2.70 before the selloff, plunging 70% to $1.00, while BNB, which saw 2 yield-farms run on its Binance Smart Chain exploited on the same day, plunged from $550 to $275. Venus protocol (XVS), which is run on BSC, saw its token crash from $145 to below $30 after it was exploited for around $200 million. Needless to say, it is all bloodbath across the altcoin segment, with most altcoins not even being able to see any sign of a bounce.

With such brutal blood-letting, it could take a while for the market to find its feet again. Price action this week will be keenly watched to see if the market manages to recoup losses and go higher, or that a longer period of consolidation could be ahead. All that leverage in the altcoins need to be reset if the altcoin segment is to see a sustainable rebound.

A lot hinges on whether BTC is able to recoup its losses back above $40,000. If BTC manages to recover to $40,000, experts expect altcoins to start recovering, while if BTC continues sliding, it could mean a very big set-back for altcoins, at least in the near-term. As fear ravages on in the market, the Crypto Greed and Fear Index is at an extreme fear level of 10, a number not seen since the March 2020 Covid-induced selloff. This could mean that now may be a good time for investors to accumulate.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.