Bitcoin again has seen some active volatility in its surge to the latest all time high of $61,000. The coin spiked and corrected, but now seems to be settling down around the $60,000 mark after that bout of volatility.

Having slowed its climb and shaken off its fall, the more stable Bitcoin market has investors looking towards altcoins which are doing the rotations in terms of rises and falls.

Smaller cap altcoins seem to be the flavour of the week as big pumps are being witnessed lowerdown the market cap standings. Names like NPXS and BTT have pumped over 150% recently for example.

It is also the continued surge of DeFi that is having an impact on some of the smaller cap coins as a lot of the bigger pumping ones have some sort of DeFi connection.

In the traditional markets the mixed signals from the Fed has left the stock market a little confused. From the Fed promising to keep interest rates low, to then announcing it would not extend the pandemic crisis rule that allowed banks to relax capital levels, the stock market has not known which way to go.

A Mixed Bag

The overall picture in traditional markets last week was mixed where markets first rose after the Fed reiterated commitment to keep interest rates at current low levels until at least 2023, but fell later in the week after the Fed announced on Friday that it will not extend the pandemic crisis rule that allowed banks to relax capital levels.

This will raise the capital requirement for banks, thereby reducing their ability to extend loans. With this news, stocks sold off, led by banking and financial stocks. The Dow and S&P both fell around 2% off their ATHs on Friday, but remained unchanged for the week. Nasdaq fell around 1% after tech selloff resumed on Thursday and Friday.

With the mixed signal that the Fed is sending, choppy sessions are expected ahead with the 10-year Treasury yields crossing above 1.7%, yet the USD has failed to breach the 92 level. The market is appearing rather uncertain with no clear direction, with Gold and Silver advancing around 1% each, but Oil plummeting 10% to a low of $59 before closing the week at $61.50.

Oil prices dropped despite a decrease in US oil inventories, as a resurgence of Covid19 cases in Europe saw traders take profit since the rally in oil price has been ongoing for months.

In the policy meeting just passed, the Bank of England (BOE) assured that it will continue with its bond purchases this year, citing risk to activities still skewing to the downside. Problems about vaccines as well as a resurgence of cases in Italy and France is a cause for concern. The announcement sent the GBPUSD falling from $1.40 to $1.3870.

As we start the new week, the Turkish Lira plunges 16% to near its all-time-low after President Erdogan sacks hawkish central bank governor and installs a like-minded dovish central banker. The USD/TRY has started the week rallying to 31-month highs above $8.00.

Historical Liquidations As BTC Pull Backed Early Week

On the Crypto side of things, the early part of last week saw some panic selling induced by traders after India announced a proposed full crypto ban. As the market was caught long, the drop in BTC and the broad market was intense, with BTC falling from $61,800 to $53,000.

More than $2b worth of crypto spot positions were liquidated in the first 24 hours on Monday, with liquidations in Perpetual Futures contracts at ATH, exceeding $1b in just 1 hour. This spoke of excessive greed among traders after BTC price crossed $60,000 in the weekend, which needed to cool off in order for BTC to post a more sustained gain.

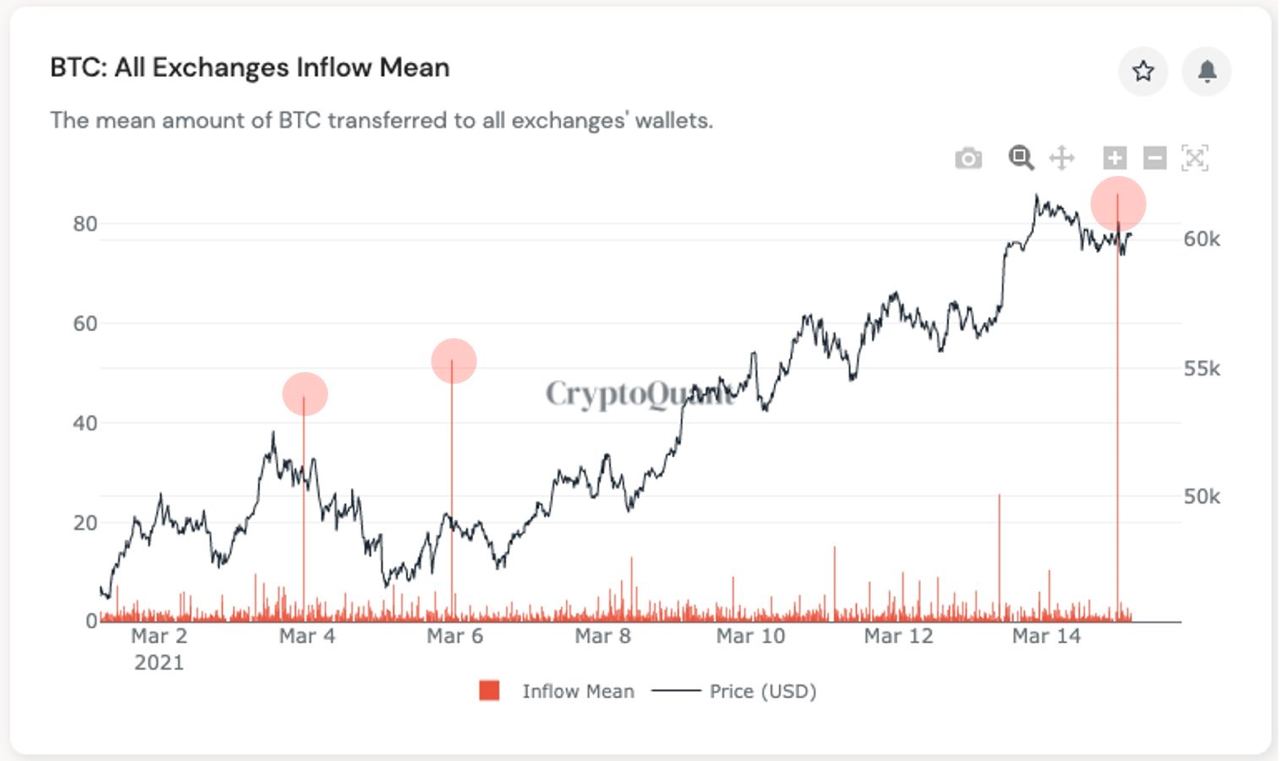

Investors and traders also bailed out of the market before the US FOMC meeting, where Fed Chair Jerome Powell would be speaking about interest rates and the recent yield spikes. BTC inflows to exchanges climbed to a high of around 80,000 units as investors sent BTC to spot exchanges after the price crossed $60,000.

One particular trigger which started the cascading selling was the disputed transfer of 18,900 BTC to Gemini Exchange which worried traders who started a bout of selling. Some analysts said it was a false alarm as the transfer was internal, while others said the transfer was real. While Gemini said that the transfer was internal, some data seem to suggest that it indeed was a transfer from an external wallet.

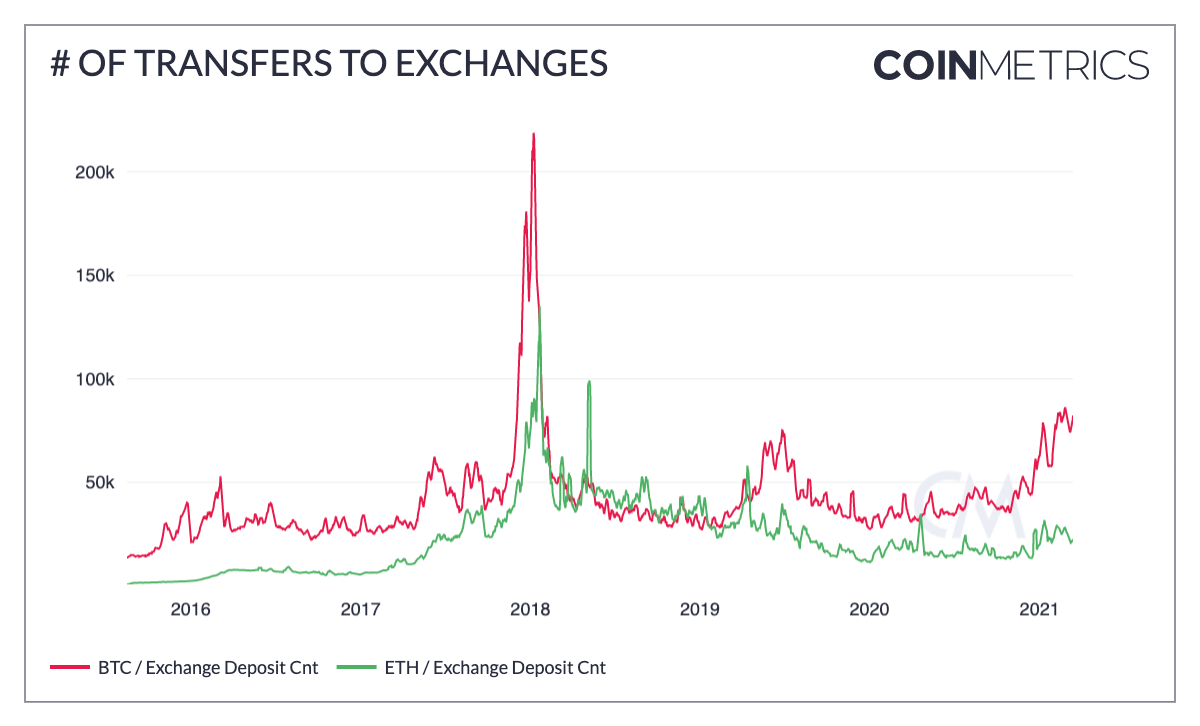

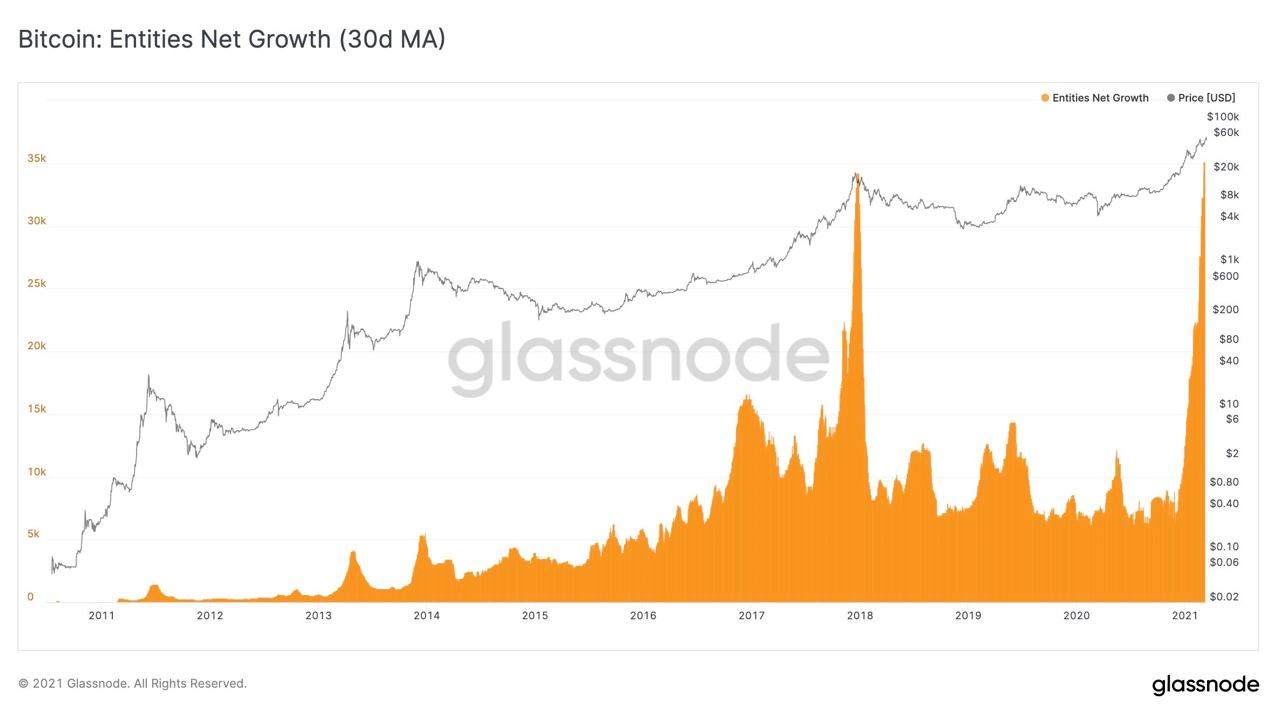

Even though inflow to exchanges climbed significantly last week, it was still way below that in 2018 which ended the bull cycle then. This, coupled with some other statistics, could mean that the current bull market may have room to run further.

For instance, another data set revealed that new entrants to the cryptocurrency market this time have exceeded that in 2017-2018, while the peak of exchange inflows is a lot lower, implying that the new buyers are not selling their BTC yet.

One such new entrant is Meitu, who announced that it has added another 16,000 ETH and 386 BTC during the dip last week, taking its total consideration to around $90m worth now.

As buyers scooped the dip, the price of BTC rebounded strongly mid-week to above $59,000 after Powell spoke what the market liked to hear, after which price fell again on Thursday, with zig-zag price action taking place throughout the week.

However, despite the seemingly erratic action, price is forming a higher low each time as buyers emerge to purchase after each dip. This may mean BTC is consolidating before another breakout which may potentially take it to $75,000 as institutional demand continues to be reported, this time with Morgan Stanley taking the lead for banks to offer crypto products to its clients.

Morgan Stanley announced it will launch 3 funds which will offer its clients exposure to BTC. While in Brazil, a BTC ETF has been approved, making it the 4th BTC ETF available for investors.

Demand is not only expected to increase from institutional investors. Retail demand is also expected to rise sharply after Visa revealed plans to allow the purchase and usage of cryptocurrencies on its platform, giving access to its 70m merchants worldwide.

Visa aims to become the bridge between crypto and fiat as its merchants will still be collecting fiat as payment, with Visa converting client’s crypto into fiat when they make payment.

Even Twitter has gotten into the BTC adoption wagon by incorporating a payments app called BottlePay into Twitter. BTC can now be sent with just a tweet.

The Bottlepay app can also be integrated with other social media platforms such as Reddit and Discord. Hence, the likelihood of other social media platforms following suit is high, which means a potential flood of retail investors could be brought in.

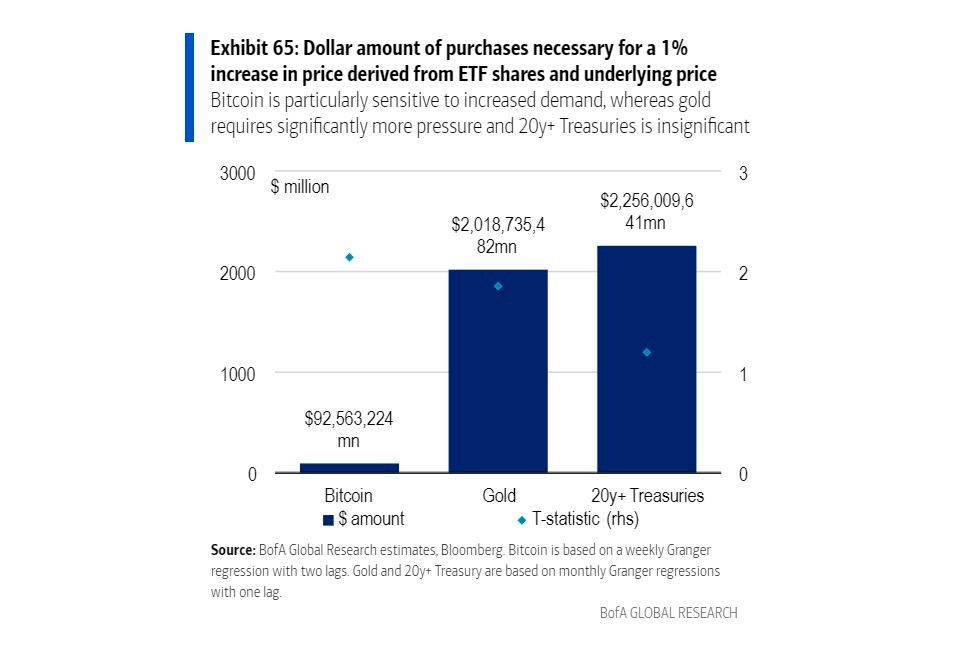

As demand gains traction, more research is being done on BTC by traditional financial firms. Bank of America tried to slam BTC by saying that only a $93m fiat inflow is needed to move the price of BTC by 1%, whereas to move the price of Gold by the same percentage will require around $2b, which shows that the price of BTC is 10x more volatile than Gold and thus, is not a suitable investment asset.

However, most crypto experts beg to differ, arguing that since BTC is still young and a lot smaller in terms of market cap than Gold, it is to be expected that BTC has higher volatility. By the time BTC grows to as large as Gold and has less volatility, the best gains would have already been made. The profit potential more than compensates for the high volatility.

Deutsche Bank, on the other hand, sounds more bullish in their report. According to them, BTC is now the third-largest currency in circulation behind the USD and Euro, with its total value around 102% of the Yen in circulation, 65% of Euro, 53% of USD, and 904% more than that of the British Pound. Hence, Deutsche Bank thinks BTC is too important to ignore.

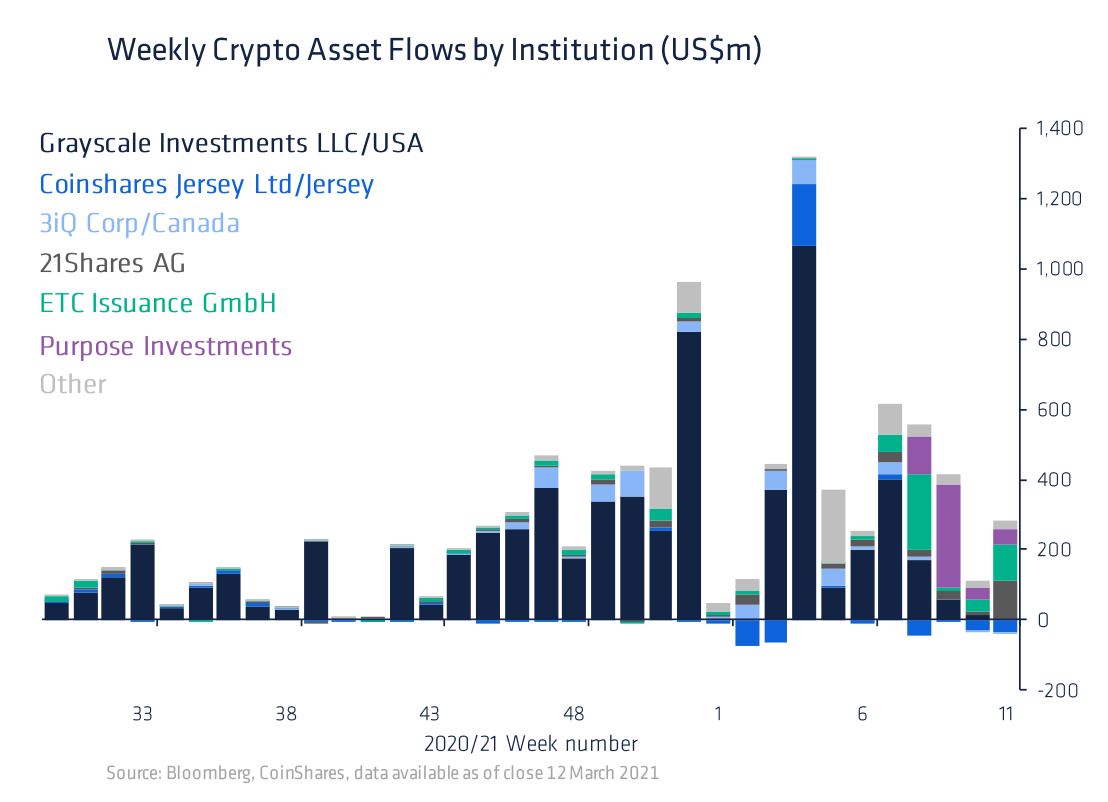

Grayscale Premium Becomes Discount Due to Competition

A tabulation of institutional Crypto Fund flows shows a record $4.2 billion inflow in Q121, with Purpose Investments ETF product in Canada taking market share away from Grayscale Investments. Hence, we can safely deduce that the negative premiums on GBTC and ETHE are the result of clients leaving Grayscale, not that they are negative on the outlook of cryptocurrencies. Perhaps giving in to pressure from increased competition, Grayscale revealed that it is launching 5 new investment trusts on LINK, BAT, FIL, MANA and LPT soon.

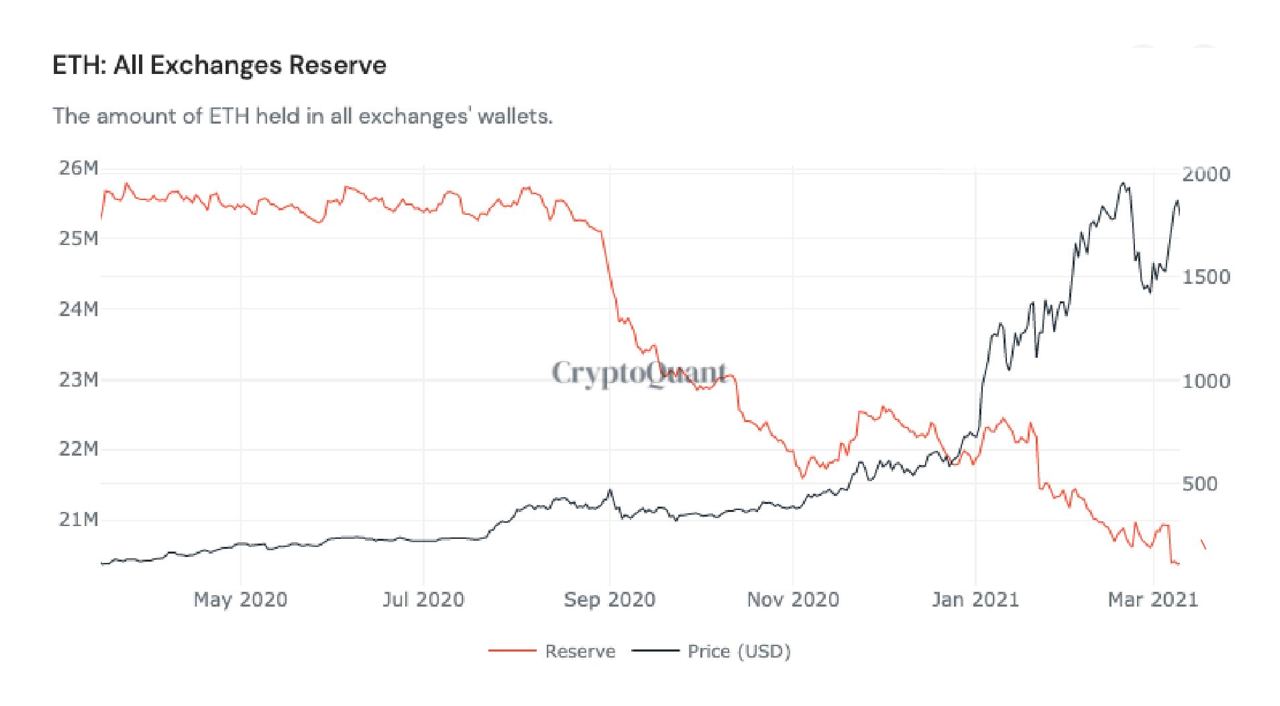

ETH Supply Held At Exchanges Falls Further

Meanwhile, after stabilising between Nov last year and Jan this year, ETH supply held at exchanges is falling again, with a total of only around 20m units of ETH held across all exchanges. This positive development may be due to recent news of upgrades coming that may boost the price of ETH, making buyers of ETH to remove them for long term safe keeping.

Other than exchange supply declining again, whales holding more than 10,000 ETH declined only 0.9% over the past 4 months, implying that these whales have not sold their ETH. However, wallets with less than 10,000 ETH have fallen by 7.2%. This phenomenon is similar to that of BTC, where investors with a larger appetite, likely to be institutions or large corporates, have been holders, while smaller-sized investors like private individuals may have been more inclined to take profit.

As more large whales accumulate ETH, the supply available for buying and selling is reducing in the same way as that of BTC. However, come July, when the fee burning upgrade for ETH kicks off, the available supply of ETH may decline a lot faster than that of BTC, which could trigger a larger price explosion for ETH.

The options market is also heating up for ETH, with Open Interest in ETH options increasing by 50% to reach $3.1b over the past 2 months. This has resulted in a historic $1.15b worth of ETH options set to expire on March 26, which may increase the price volatility of ETH as we move closer to the date.

While larger coins consolidate, rotational play is going on with the smaller cap altcoins, with new coins being pumped every week. Last week, action was on low-valued coins, with old favourite names like NPXS and BTT pumping over 150%.

As a round of pumps near an end with the pumping of low-priced coins, will we see the move of large cap coins like BTC and ETH next to lead the market up? The DeFi coins, who have been the front runners of this bull run, are carving out some healthy recovery after being quiet for about a month.

However, the CFTC announced over the weekend that it has fined Coinbase $6.5m for wash trading, inciting fears of regulatory intervention again. This fear caused the markets to sell off again, with sellers appearing as BTC approached $60,000. Bids are coming in at around $55,500 and we shall see if BTC is able to break free from the $60,000 curse this week and move higher, or if fears of regulatory actions will cause a deeper pullback in the market.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.