The cryptocurrency market is starting to look slightly bullish again after a short stint in a bear market. Major milestones for both Bitcoin and Ethereum have been breached. The former jumping above $40,000 and the latter reaching $3,000.

For Ethereum, the move seems to be correlated again towards its major upgrade. This time it was the London hard fork being successfully implemented that helped. With this fork, Ethereum is taking bigger steps towards its goal of Ethereum 2.0, which many investors feel will be a game changer for the blockchain ecosystem.

There are a lot of metrics to look at with regards to Bitcoin. The major cryptocurrency managed to shake off FUD in the US surrounding tax changes which would impact holders. Additionally, on-chain, there is evidence of Bitcoin miners sending their coins to exchanges, which could indicate they are ready to sell them — but this may not be cause for concern.

Elsewhere, Stocks tied to economic recovery rose on Friday after better-than-expected July jobs numbers, sending the Dow and S&P to new ATHs. The report showed that the U.S. economy added 943,000 jobs in July vs a consensus of 845,000 jobs last month, while the unemployment rate improved to 5.4% vs estimates of 5.7%. Economists polled suggested that the report showed that the economy was recovering, but not so quickly to force immediate action from the FED, which is good for the markets.

The Dow gained 144.26 points, or 0.4%, and closed at an ATH of 35,208.51. The S&P 500 rose nearly 0.2% to clinch its own record close at 4,436.52, while the tech-heavy Nasdaq was the worst performer, losing 0.4% to settle at 14,835.76.

For the week, the Dow rose 0.7% for its second positive week in three. The S&P 500 rose 0.9% and is now up 18.1% for the year. The Nasdaq rose 1.1% for the week.

10-year Treasury yields remained calm, closing the week at around 1.3%.

While the USD advanced, other currencies lagged, with the DXY inching higher to 92.8, looking to pierce the 93 level resistance in the days ahead. With the USD higher, Gold, Silver and Oil declined, with Gold breaking the $1,800 support, closing the week at $1,763 and Silver $24.40. The new week begins with Gold down 1.4%, and Silver looking weaker, falling 1.8%.

Oil had a bad week, falling 6.8% in one of its worst weekly declines in 4 months on demand worries as the cases of the COVID Delta Variant continue to spread at an even quicker pace. The recent rise in US Crude inventories also raised concerns over increased supply at a time when demand is expected to decline. However, renewed tensions in the Middle East could give some support to Oil price if the situation surrounding Iran and Israel worsens. Oil opens the new week on continued weakness, down 2% at around $66.80.

However, cryptocurrencies were unaffected by the strong USD, surging for yet another week, this time, led by the number two coin ETH after its successful London Hardfork. ETH surged around 25% from $2,500 to above $3,100. The King of Crypto BTC, didn’t fare too badly either, surging 19% for the week from $37,300 to a high of $45,300 before both cryptos are retracing to start the week after being severely overbought.

Crypto Market Ignores Tax Bill FUD to Surge Higher

Crypto market started last week pulling back after BTC’s dazzling rebound over the weekend on the back of chatter surrounding the proposed new US Legislation Bill, which included a tax segment that would collect taxes on a wide range of crypto businesses, even including individuals participating in DeFi, as well as software developers. The FUD was enough to scare traders into huge dumps from Monday till Wednesday when the markets finally calmed down after senators proposed changes to the bill to exclude individuals and software developers. The amendments had continued to be debated late into Saturday and continues to be debated as we start Monday.

Gary Gensler, the new Chairman of the SEC, could also have helped calm some nerves mid last week after he spoke well of BTC in two interviews on Tuesday and Wednesday. He, however, mentioned that if BTC is going to meet its potential, it needs to come within public policy frameworks, signaling that regulations are needed for the industry. This however, has been well-taken by the market as reasonable regulations could instill greater confidence and bring more investors into the market.

Wednesday also saw news from Uruguay that said that a senator from Uruguay has proposed a bill to allow businesses to accept cryptocurrencies as payments and regulate their use within the South American country.

Further to that, Dubai also announced that cryptocurrencies will now be accepted as a form of payment in Dubai’s KIKLABB free zone. This makes it the first government-owned entity to accept cryptocurrencies.

Miners Sold BTC But Should Not Be Cause For Concern

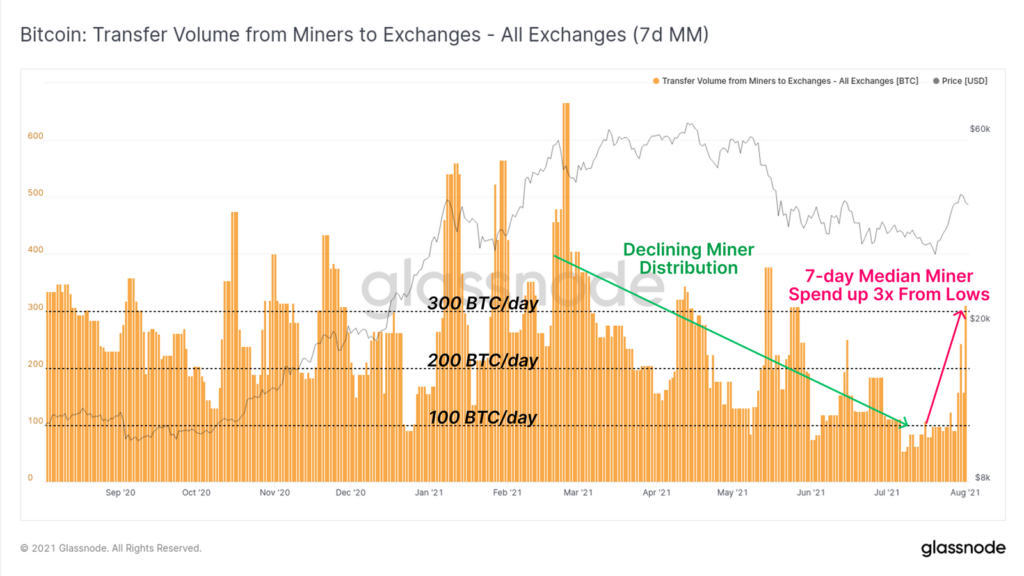

BTC volume sent by miners to exchanges have increased sharply early last week as price broke $42,000, with the 7-day average miner transfer to exchanges up 300% from its low from early July. This suggests that miners have taken the rebound last week to offload BTC. This, however, may not necessarily mean that miners are bearish, as current miners are reaping 2x the reward ever since the miners in China went offline. Hence, miners selling could simply be a case of them cashing out some of their “sudden windfall”. Once more miners plug back in, this situation would resolve by itself.

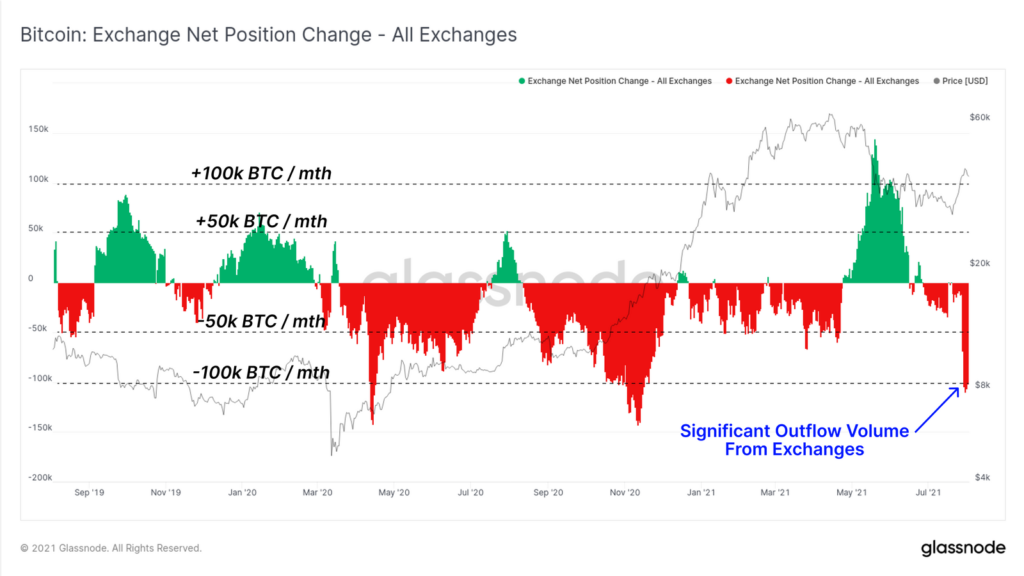

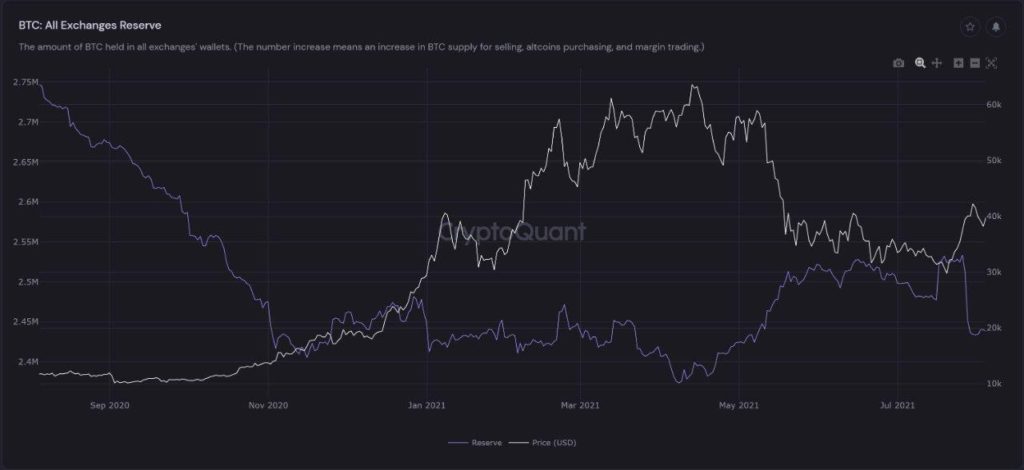

Despite miners selling, long-term holders and new individual investors are continuing to buy and remove BTC from exchanges. Outflow from exchanges continued to be high last week.

BTC Transaction Volume Rises Sharply, Long-Term Holder Concentration Increases

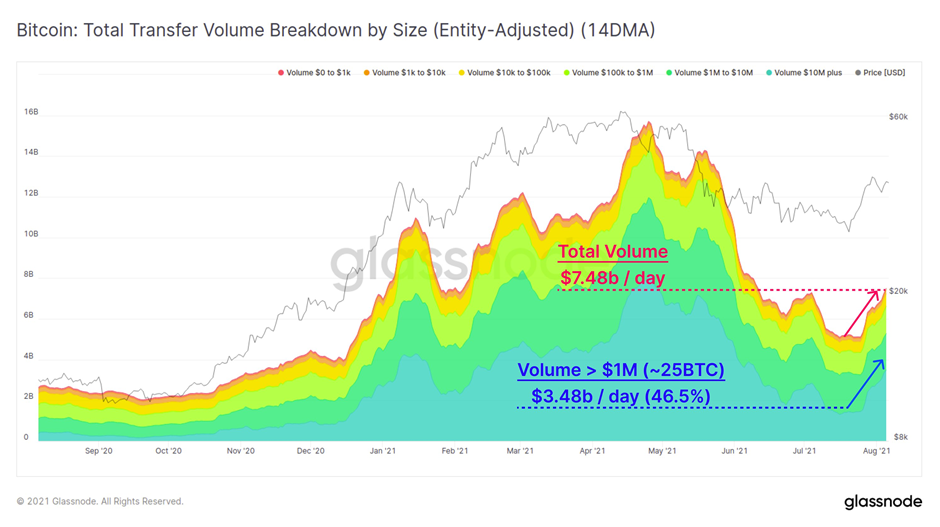

The large outflow volume on exchanges is further reinforced by a rebound in transactional volume witnessed on the BTC blockchain recently, with entity-adjusted transaction volume increasing to $7.48 billion per day over the last 14-days. In particular, transactions over $1 million in value, or around 25 BTC, are on the rise. Transfers of this size and above takes up about 46.5% of the total transaction volume, a sign that affluent buyers are scooping up BTC.

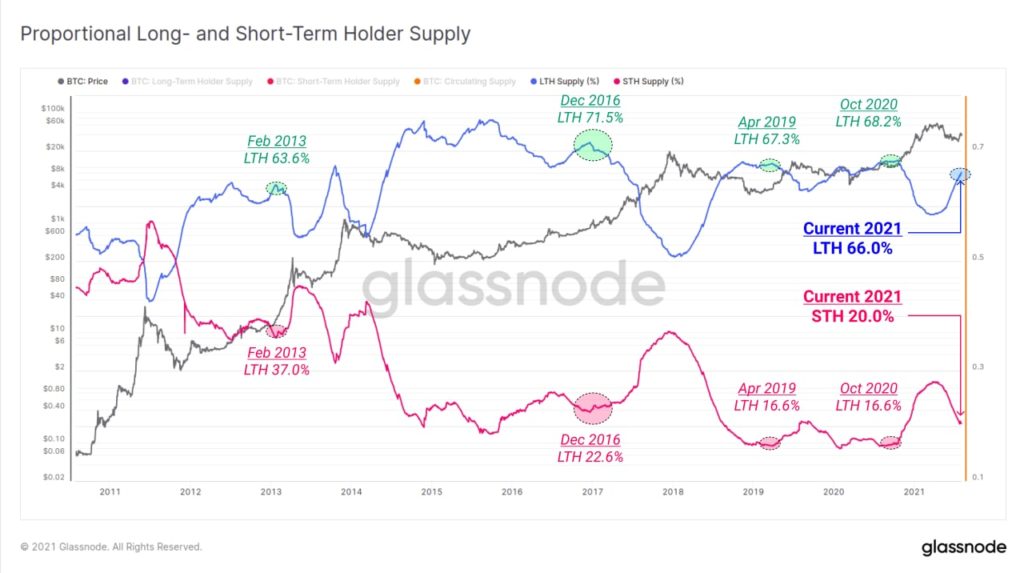

As BTC continues to be acquired by more affluent entities, the long-term holders (LTHs) who have no history of selling continue to grow. As of now, the proportion of BTC supply held by LTHs continues to trend higher as more coins are held dormant. According to data, previous bull markets were triggered when LTH concentration reached between 63.6% and 71.5%. However, the bull markets started often after many months at these levels. LTHs currently hold 66% of the BTC supply. Could this be yet another sign that the bull market could be resuming soon?

Low Funding Rate And Other Metrics Suggest This Rally May Have Legs

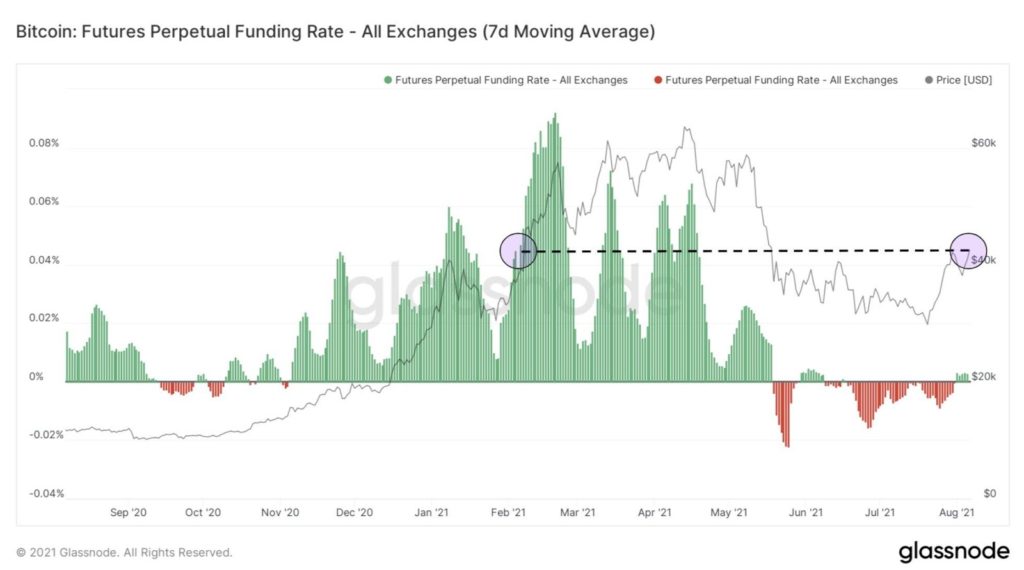

To determine if this current up move is sustainable, a check on BTC funding rate shows a very healthy sign. Despite BTC rising rather sharply from $37,500 to $44,000 the past few days, funding rates have remained low, turning only slightly positive. This is a very far cry from the high funding rate seen from Feb to April’s rally where funding rate was much higher, implying that the then rally was driven primarily by leverage. This time around, the move is spot market driven, meaning people are using cold hard cash to buy and will be able to withstand drawdowns a lot better. This means the buyers have the capacity to hold long-term.

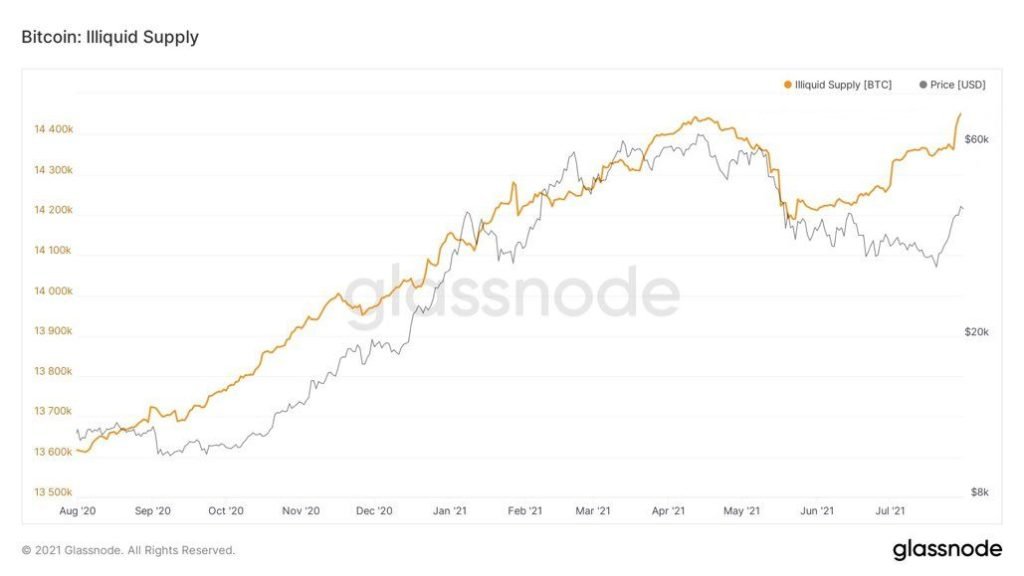

Other than all the above metrics, BTC illiquid supply also broke ATH last week, signaling that the supply crunch is intensifying.

The number of new entities also grew sharply last week, suggesting that many new buyers of BTC could have emerged, with new entity growth hitting a historical high of close to 60,000 new entities in a week.

In line with the surge in new entities, the BTC balance on exchanges also showed a sharp decline, confirming that these new entities were buying and removing BTC from exchanges.

Thus far last week, other than a slight uptick in miner’s selling, most other important metrics are showing positive signs all at the same time.

ETH On A Tear As London Hardfork Goes LIVE

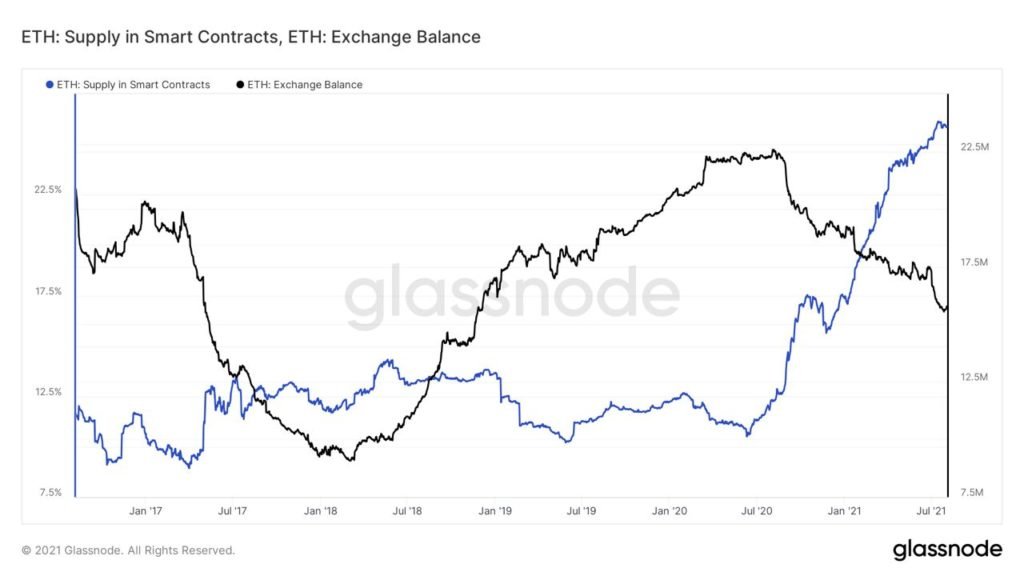

Other than BTC, metrics for the number two coin ETH, are also showing signs of positivity. For instance, ETH balance on exchanges continues to fall, while ETH supply locked in smart contracts continues to climb. Even though early last week saw exchange balance rise a little in tandem with a fall in ETH supply locked in smart contracts, this was to be expected as investors began to avoid using ETH and erc-20 tokens ahead of the London Fork.

While many yield-farmers removed liquidity from ETH-based platforms ahead of the fork, some traders also took advantage of the huge rally in price to sell before and buy back later after the fork. Despite this, the percentage of ETH locked in smart contracts still remains near an ATH of 26%, while TVL in ETH-based farms fell from $95 billion to $89 billion.

This fall in TVL is likely temporary since many yield-farmers are expected to return to their pools once they feel assured enough that their farms are safe to participate in once the ETH network settles down post fork.

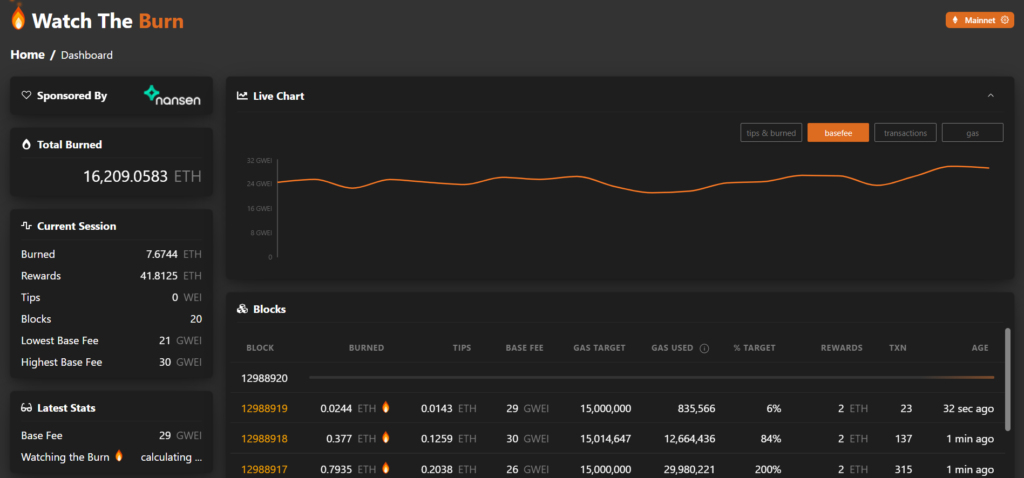

Following the successful launch of the London Hard Fork on Thursday, market participants continued their bullishness as the introduction of EIP-1559 would mean that more ETH will be burned as more transactions are being done. It is especially rewarding for ETH holders to watch live as more ETH gets burned.

According to various on-chain sources, more than 16,000 ETH worth around $49 million have already been burnt as of the point of writing.

ETH co-founder Vitalik Buterin has hailed the London Hard Fork a success, adding that it has given him more confidence over the upcoming merge to the ETH 2.0 chain, further fuelling positive market sentiment.

According to published data, the current ETH Mainnet will “merge” with the proof-of-stake Beacon Chain, marking the end of proof-of-work for ETH. This is planned to precede the rollout of shard chains and even though Buterin has mentioned that it is likely to only happen early next year, some developers are trying to accelerate the process. Once merged, the new Mainnet will have the ability to run smart contracts on PoS, reducing the network’s energy consumption by 99%.

Altcoins Watch in Awe As DOGE Moons 50% in 2 Days

With the rise in BTC and ETH, altcoins also had a good week, although they were overshadowed by the fast and swift rise in BTC and ETH, which saw over 25% gains in a few days. One of a few exceptions which outshined the top two coins was DOGE, which mooned 50% in 2 days after the DOGE community rallied around to promote the token, making it trend on Twitter in many countries. Even the community of ETH joined in, with both communities shilling the DOGE-ETH bridge together, propelling both tokens even higher after the success of the London Fork took confidence to a higher level. The activities brought upon by the DOGE community even caught the attention of Twitter founder Jack Dorsey, who seems to have started a private conversation with Elon Musk about DOGE.

New Twist Could End Ripple’s Lawsuit Early

Other than DOGE making headlines, last week also came some important developments in the Ripple-SEC lawsuit. On Wednesday, it was revealed that the court had granted Ripple’s request to obtain international discovery. Brad Garlinghouse, Ripple’s founder, had recently filed a Motion to Obtain International Discovery to seek information from overseas exchanges. In particular, they had requested information from Binance.com.

Ripple’s lawyers explained that the documents would provide proof that the SEC’s lawsuit against Ripple’s XRP sales is invalid under Section 5 of the Securities Act of 1933.

According to the SEC’s claims, Ripple violated Section 5 of the Securities Act of 1933. However, the act only applies to domestic sales and offers of securities within the USA, contradictory to SEC’s claims of global violation. Therefore, the SEC should not have the right to sue Ripple for selling XRP to investors outside the USA.

According to legal experts, if the information from Binance.com could prove that an overwhelming majority of Ripple’s sale of XRP were to investors outside of the USA, Ripple could file a plea to dismiss the lawsuit. This could potentially help Ripple win the lawsuit almost immediately should the court’s view concur with that of Ripple’s lawyers.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.