In almost exactly three years to the day from when Bitcoin first got close to being valued at $20,000 per coin, the digital currency has finally broken the all important figure and moved to a new all time high.

$20,000 was always a strong resistance level for the coin, and after trying a few times, Bitcoin broke through this level last week, and actually moved as high as $24,000 briefly. The next movements from the coin will be interesting to watch as this is entirely new territory.

It seems however that unlike in 2017, the rally to this point and above is because of institutional interest as through 2020 there has been major occurrences of well known companies and investors singing the praise of Bitcoin — especially through the Covid-19 induced market panic seen this year.

The increase in price of Bitcoin has also had a knock on effect as a number of other coins have also skyrocketed — including Ethereum. But more than that, there has been record volume in trading across the cryptocurrency space.

Meanwhile in the more traditional markets space, there seems to be a feeling of waiting and holding on for the expected stimulus announcement from the US. All the while, there has been a recovery from the likes of Silver and Gold.

Will Bitcoin be able to rise any higher before the year closes out, could the price actually dip in this unprecedented time? Read the rest of our weekly market research report to find out.

Bitcoin Beak To New All Time High

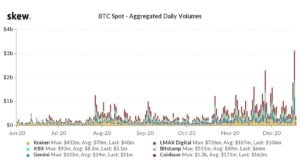

It was an exciting week for BTC and the broad cryptocurrency market as BTC finally broke the psychological $20,000 mark on record volume. Upon clearing $20,000 on Wednesday, the price of BTC pushed very fast up to a high of $23,777 within 18 hours, before consolidating at around $23,000 area on Thursday. The aggregated volume on spot exchanges spiked to more than $3 billion on Wednesday, a record high, with most of it attributed to BTC purchase.

A series of new institutional supporters drove the move, as institutions like One River Digital says it expects to own around $1 billion in BTC and ETH by 1H2021, and has already bought $600 million worth.

Further to that, another investment firm, Ruffer Investments, also confirms that it has bought $744.26 million of BTC in November, around 45,000 units. While it is still unknown who were the buyers who pushed the price of BTC past $20,000 on Wednesday, data showed that there was a big spike in stable-coin inflows to exchanges which preceded the large upswing in BTC price.

Again, this proves that the current BTC rally is backed by cash purchases made in spot exchanges, which is more resilient to downward swings, suggesting that this price level is likely sustainable, unlike that of Futures and Options which are leveraged positions which cannot withstand price volatility.

The stable-coin market capitalisation has grown to $25 billion as a result, with USDT having doubled its market capitalisation from $10 billion in September to $20 billion now.

Source: CryptoQuant

Record Volumes All Around Crypto Space

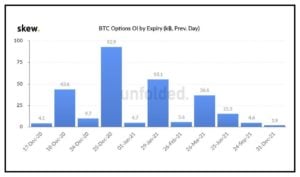

Led by the spot market, the futures market also saw record volumes, with futures volume hitting ATH of $82 billion, and open interest hitting $8 billion for the first time. The Options market also saw volume surging to above $1 billion, with open interest at ATH of around $6.5 billion.

However, traders do take note that there will be a large options expiry coming on Christmas Day, with 92,900 units or around $2 billion worth of contracts expiring. With this rally backed by institutions, the coming 2 weeks may have added downside volatility as most institutional investors go on the year-end holidays.

Institutions Are Shilling BTC, Grayscale Adds More LTC

Many institutions who bought BTC have been shilling the token, with Guggenheim saying that BTC should be worth $400,000. Meanwhile, the price premium that GBTC commands over the price of BTC has grown to 30%, meaning investors buying Grayscale Bitcoin Trust to get exposure to BTC are paying a 30% premium.

While Grayscale continues to buy BTC and ETH albeit at a slower pace last week, it bought more LTC, adding around 70,000 units to its LTC Trust. It now holds 975,000 units of LTC.

LTC has been a top performer in the top 10 coins last week, rising around 45% to a high of $110 last week, with funds like Grayscale more aggressively buying LTC, expect its price to test $150 soon should the cryptocurrency market maintain its current strength.

CME To Launch ETH Futures Next Year

Further to that, ETH also experienced a large move to the upside as news of CME launching ETH Futures February next year boosted the already positive sentiment. DeFi products also benefited from the rise in sentiment, with TVL rising from $14 billion to $16 billion last week, raising the price of DeFi tokens, and more so, contributing to ETH price increase.

The market capitalisation of the crypto market has risen to $700 billion now. With the few central banks last week reiterating an easing bias, with England, Japan and US Central Banks all continuing their asset purchases. The US in particular, promised to keep their bond purchase until the economy recovers, implying that QE will go on indefinitely. Further to that, the US lawmakers have just passed the $900 billion stimulus bill yesterday, which will give legs to the current rally.

Quiet Stock Market, Bullion Prices Recovering

The easing by the major central banks kept the stock market afloat last week, and this week, the passing of the $900 billion stimulus bills in the USA will keep US stocks edging higher. However, President Donald Trump on Friday evening, signed legislation that would kick Chinese companies off U.S. stock exchanges unless they adhere to American auditing standards.

Hence, expect some selling pressure on China companies listed in US exchanges.

Gold and silver finally broke higher last week after central banks confirmed that they will keep printing money, with both assets breaking out from their consolidation zones and looks poised to go higher as we head into the final few weeks of 2020 and into the new year.

The passing of the $900 billion stimulus bill yesterday should provide the impetus gold needs to break out of the $1920 resistance to resume its uptrend.

Information provided in Noble Pro Trades’s market report includes information provided by Kim Chua, Lead Market Analyst for Noble Pro Trades, in addition to charts from various data sources.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.