Bitcoin continues to show incredible resiliency in the face of more and more negative news pouring into the crypto space. The strength of crypto bulls could send Bitcoin targeting $12,000 in the near term.

Lack of positive movement in ongoing stimulus discussions has the stock market pulling back ahead of what could be a very bumpy ride until the US Presidential election. A resurgence of COVID and related economic conditions have weakened various global currencies against the dollar, which has regained some footing after an extended downtrend.

Bitcoin Price Holds Firm Following Suspension In Withdrawals At Crypto Exchange

Weeks ago, Bitcoin held firm as a competitor cryptocurrency exchange was hacked for millions worth of crypto assets. This week’s example thankfully doesn’t involve a security breach due to the company involved using a manual process that involves executive private key holders to make transfers from a cold storage wallet to a hot wallet to release customer withdrawals.

Also Read: Learn How Noble Pro Trades Protects User’s Funds

The company immediately announced the temporary suspension of withdrawals of crypto assets, including Bitcoin. Authorities have detained the exchange key holder in question while customers await the next steps.

Bitcoin price fell abruptly at the news, but bulls have already brought the price of Bitcoin back to the vital level and even higher since.

Bitcoin has thus far failed to build enough bullish momentum to reclaim $12,000, but that could be right around the corner considering how firm the cryptocurrency has held even in the face of disasters around every turn.

If resistance above $11,700 continues to act as a barrier to revising 2020 highs, the next logical downside target would be filling the CME gap left behind at $11,000.

Grayscale Investments Absorbing Scare Crypto Supply At Hastening Rate

Bitcoin and other crypto assets are digitally scarce supplies, thanks to the code they are built on. These low supplies are part of why cryptocurrencies are such volatile assets, and their valuations rise and fall so rapidly.

Based on supply and demand dynamics alone, big buyers of crypto assets can drive up prices much more quickly with more considerable capital to throw around. A strong example of this has been in the recent news of Square, Inc. buying some 4709 BTC. But that move came after a $425 million purchase of BTC from the Nasdaq-listed MicroStrategy, who picked up eight times the BTC supply that Square did.

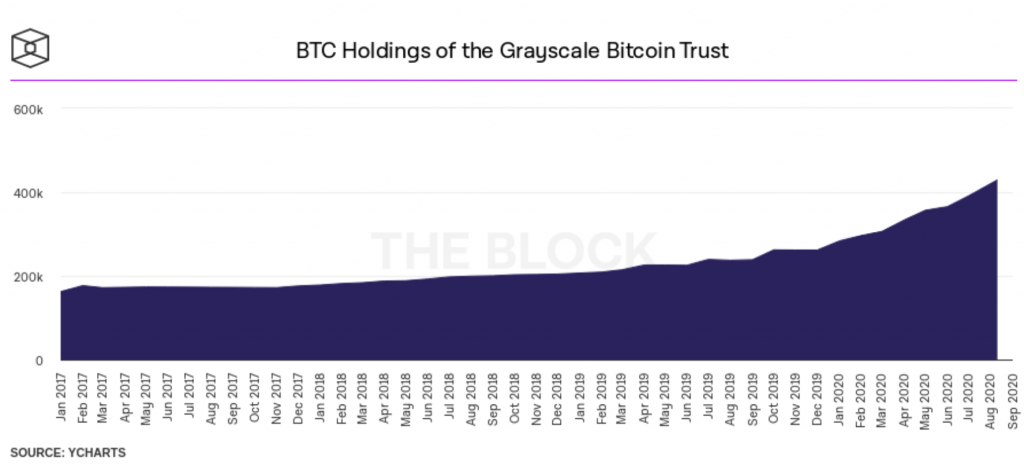

But even more shocking and a more substantial blow to these crypto asset’s limited supplies has been Grayscale Investments, which has had its BTC holdings balloon to 450,000 BTC – or around 2.5% of all circulating BTC.

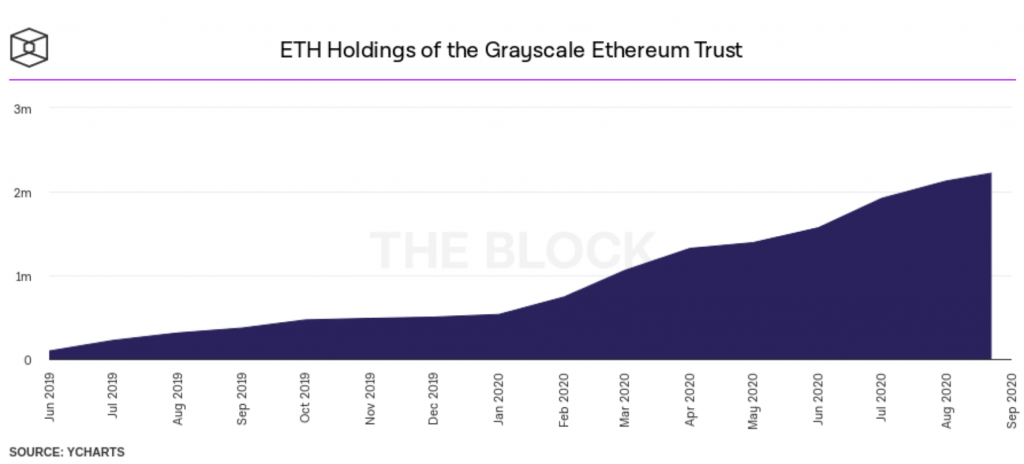

GrayScale’s accumulation of ETH, however, has been far more substantial in terms of supply. According to the latest figures, GrayScale’s Ethereum stash is now above 2 million ETH and growing.

Ethereum And DeFi See Late October Revival, Stablecoins Rise

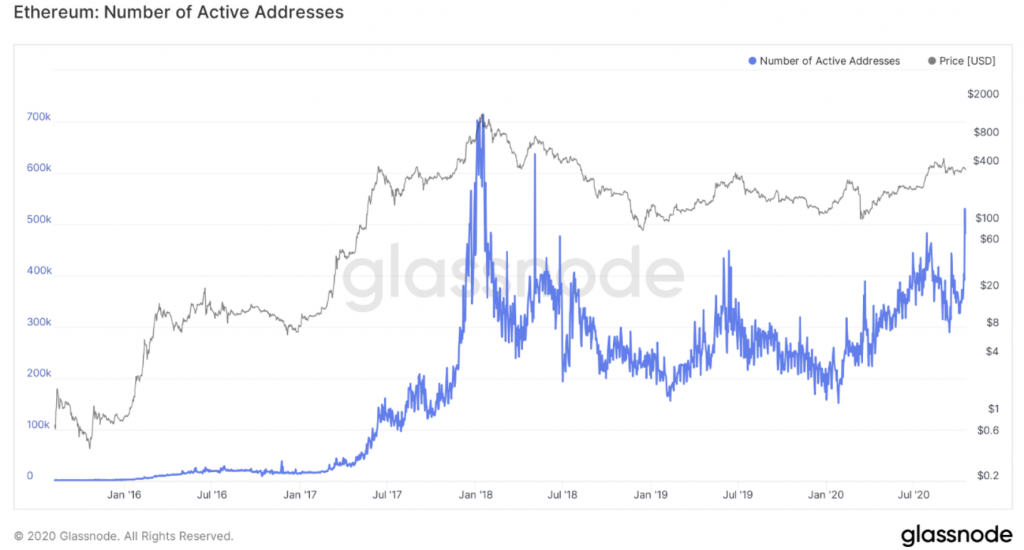

While on the topic of Ethereum, the second-ranked crypto asset by market cap cooled off in September and into early October due to DeFi tokens getting perhaps too overheated. A new NFT (non-fungible tokens) trend is starting to pick up in pace and has helped breathe new life back into Ethereum.

Like DeFi tokens and ICOs before them, most NFTs are built on the Ethereum blockchain through smart contracts. This booming trend has the spillover effect of benefiting the underlying blockchain, in which case is Ethereum once again. Coinciding with the rebound in Ethereum usage has been a resurgence in active ETH addresses, which has returned a high not seen since the crypto bubble peak in 2018.

The increase in activity in Ethereum could also be due to investors preparing for the ETH 2.0 update, expected to launch by the end of the month. At that stage, Ethereum will switch from a mining-based protocol to a staking-based protocol.

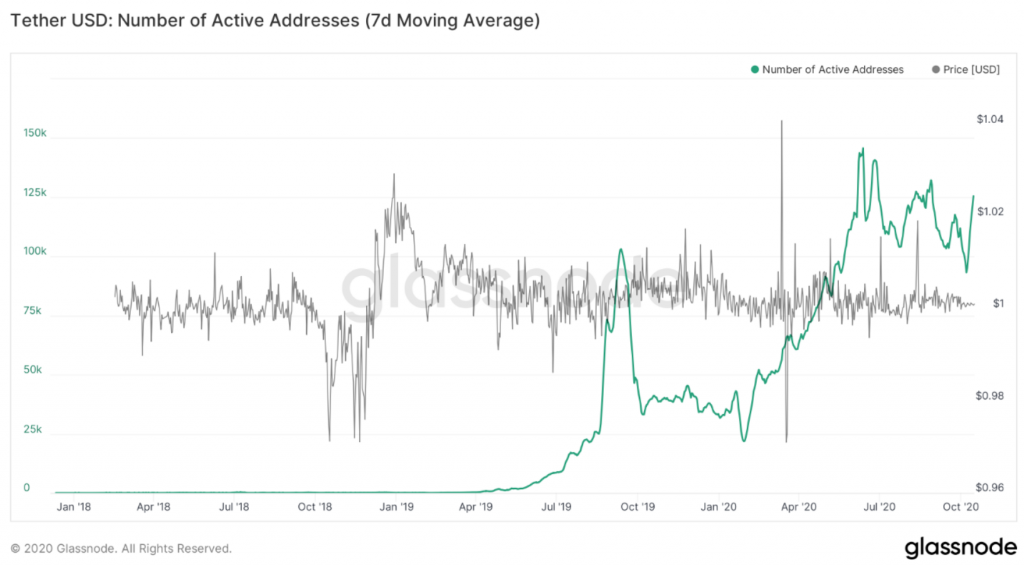

In addition to Ethereum growth, the third-ranked crypto asset, Tether, also saw another $1 billion in supply added this month, taking the total market cap top $16 billion and climbing. Daily transactions have surpassed $35 billion. The Tether supply growing helped Bitcoin rise in the past, so crypt investors are hopeful the correlation occurs again.

Stocks Suffer From Stimulus Deadlock, Election Uncertainty

US Republicans and Democrats remain in a deadlock over the total costs of proposed stimulus packages. The President himself rejected the most recent proposals, then declared he was ready to sign if a package was presented that included stimulus checks for individuals only.

Still, there’s been no positive movement, and the economy continues to suffer as a result. Alongside the dwindling US economy, major US stocks like the Dow Jones and S&P 500 also had a pullback. The Dow plunged 400 points ahead of last week’s close.

There are also only two trading weeks left ahead of the controversial US Presidential election, where a winner will finally be decided between Trump and Biden and who will lead the US for the next four years. The election is expected to be highly contested due to mail-in ballot issues and Trump’s reluctance to go down without a fight should he not win by a landslide.

AUD, EUR, GBP: Forex Currencies Weaken As The Dollar Regains Strength

Investors uneasy in stocks and other asset classes have prompted a selloff into the US dollar’s safe haven – the current global reserve currency.

Other major forex currencies, EUR, and GBP have felt the sting on the other end of the trade. A resurgence of COVID cases from a potential second wave causing more lockdowns has prompted a pullback in these two majors. Brexit deliberations and threats of a no-deal exit have only made matters worse.

Across the globe, the RBA Governor hinting at a rate cut from 0.1% to 0.25% to alleviate currency pressures further weakened AUD. The latest China ban on Australia Coal also contributed to the decline. AUDUSD traders will want to watch for the 0.70 support to break down along with the last interest rate meeting on Tuesday, October 20.

Information provided in Noble Pro Trades’s market report includes information provided by Kim Chua, Lead Market Analyst for Noble Pro Trades, in addition to charts from various data sources.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.